India and the United Kingdom have dramatically expanded their economic ties since 1990. In the early 1990s, bilateral trade was relatively modest – on the order of only a few billion USD – as India was just beginning to liberalize its economy. By the mid-2010s, total goods trade had grown to around $15 billion annually, and by the mid-2020s the inclusion of services trade pushed total bilateral trade to roughly $50 billion per year.

The UK–India FTA, finalized in May 2025, represents the largest and most comprehensive bilateral trade agreement for the UK post-Brexit. Slashing tariffs on 90% of UK exports to India and liberalizing services trade, the deal is projected to boost UK GDP by £4.8 billion annually, raise wages by £2.2 billion, and expand bilateral trade by £25.5 billion.

China’s industrial sector remains under stress as profits at large industrial firms declined 1.8% year-over-year in the first half of 2025, reaching CNY 3.44 trillion, according to data released by the National Bureau of Statistics (NBS).

US equity markets closed the week on a high note, with the S&P 500 rising 0.4% on last Friday, marking its fifth consecutive record close the longest such streak in more than a year.

European equities faced broad-based declines on Friday, with both the STOXX 50 and STOXX 600 falling 0.5% amid investor concerns over disappointing corporate earnings and the lack of clarity on a potential US–EU trade agreement.

The United Kingdom’s consumer sentiment weakened in July 2025 as households began bracing for potentially adverse fiscal conditions. According to the GfK Consumer Confidence Index, sentiment edged down to -19 from -18 in June, interrupting a six-month upward trend and indicating a renewed sense of caution.

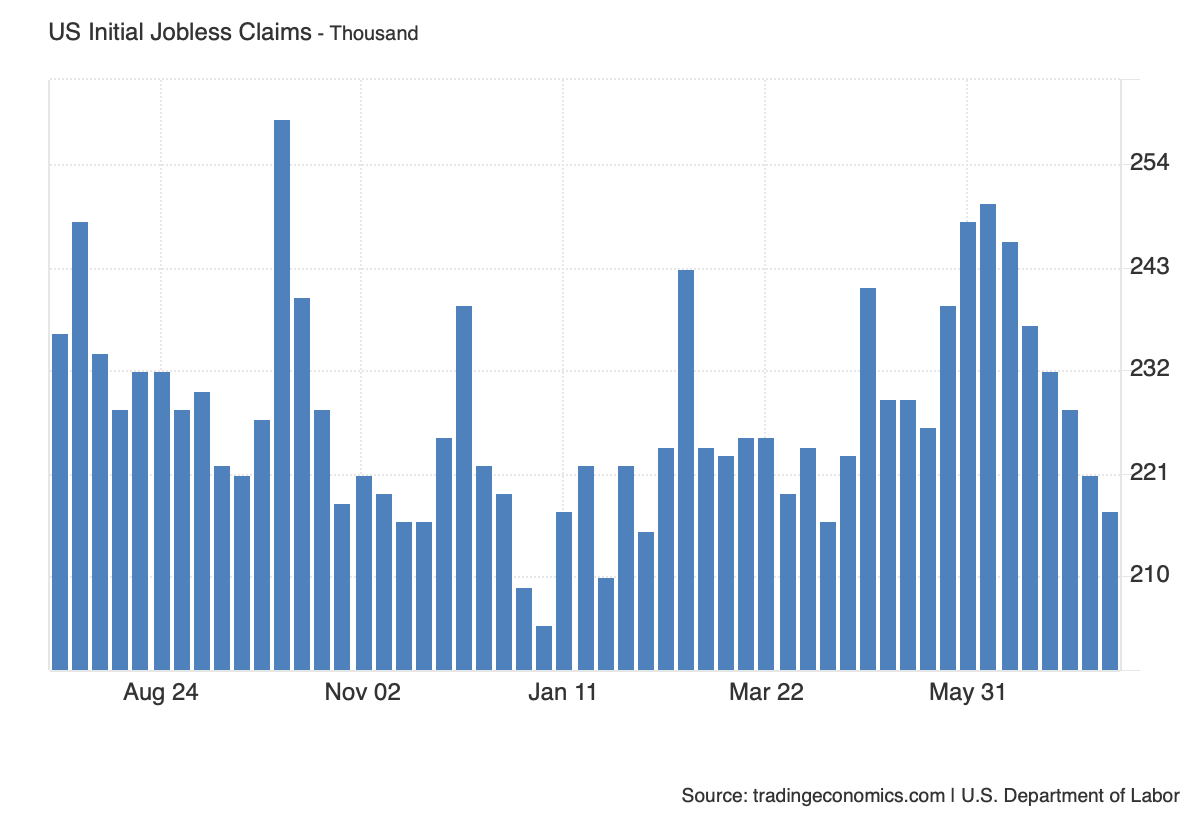

Initial jobless claims in the United States fell to 217,000 in the week ending July 19, 2025, marking a decline of 4,000 from the previous week and defying market expectations, which had forecast a rise to 227,000.

India’s manufacturing sector surged forward in July 2025, with the HSBC India Manufacturing Purchasing Managers’ Index (PMI) climbing to 59.2, up from 58.4.

West Texas Intermediate (WTI) crude futures rose above $66 per barrel on Friday, continuing their upward momentum for a second consecutive session amid growing optimism surrounding global trade negotiations and renewed concerns about supply-side disruptions.

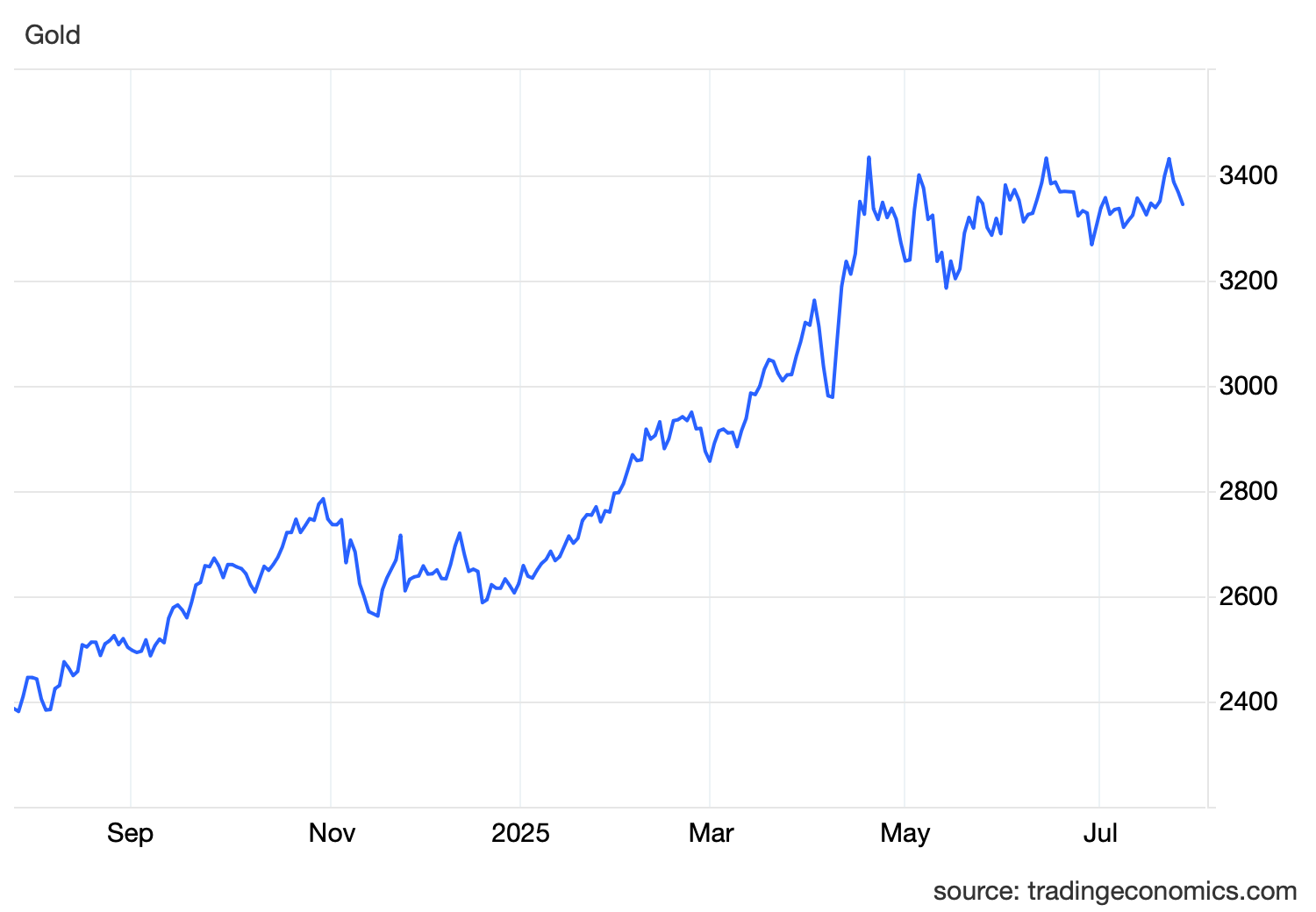

Gold prices declined to approximately $3,360 per ounce on Friday, marking the third consecutive session of losses and reflecting a notable shift in investor sentiment.

U.S. stock futures nudged higher early Friday after Wall Street ended Thursday’s session with broad-based gains, led by record closes in both the S&P 500 and the Nasdaq Composite.

The UK’s annual inflation rate accelerated to 3.6% in June 2025, according to the latest figures from the Office for National Statistics (ONS), marking the highest level since January 2024 and surprising markets that had expected the rate to remain steady at 3.4%.

The Australian dollar weakened further on Friday, falling to around USD $0.658, extending the losses from the previous session as markets turned cautious in anticipation of crucial domestic inflation data scheduled for release next week.

China’s export sector posted stronger-than-expected growth in June 2025, with outbound shipments rising by 5.8% year-on-year to USD 325.2 billion, slightly above consensus forecasts of a 5.0% increase.

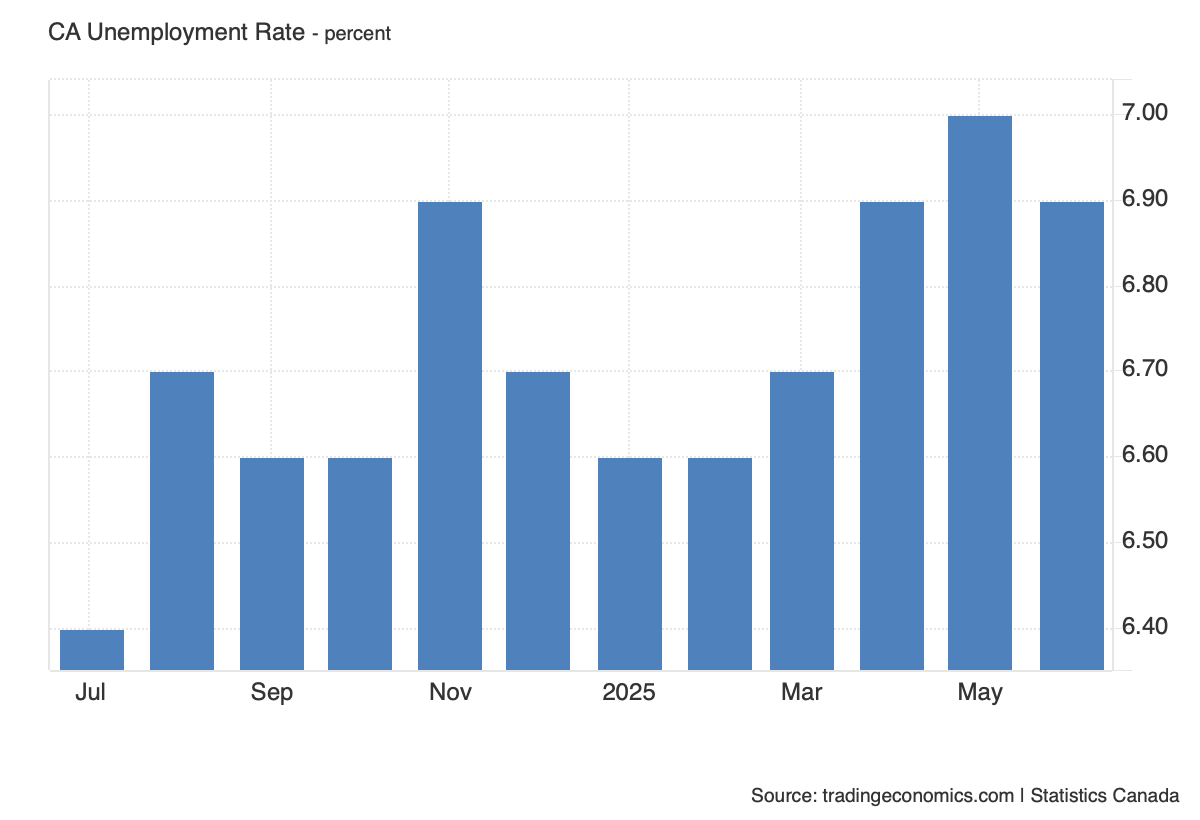

Canada’s labor market showed an unexpected sign of resilience in June 2025, as the national unemployment rate edged down to 6.9% from 7.0% in May, breaking a five-month streak of deterioration and defying market expectations of a further increase to 7.1%.

Copper futures in the United States surged to $5.5 per pound on Friday, easing slightly from the intraday record high of $5.7 but still closing nearly 10% above Monday’s level.

Brent crude oil futures declined to $69.2 per barrel on Tuesday, easing from a two-week high as markets digested a complex mix of bearish trade policy signals and supply-side developments.

Japan’s household spending jumped by 4.7% year-on-year in May 2025, marking the strongest expansion since August 2022 and sharply reversing the marginal 0.1% contraction recorded in April.

US stock futures edged higher on Thursday, with contracts tied to the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all up by 0.3%, as investors digested fresh labor market data that reaffirmed the resilience of the US economy.

Uranium futures in the United States fell to $71 per pound, retreating from a seven-month high of $79 reached on June 27th.

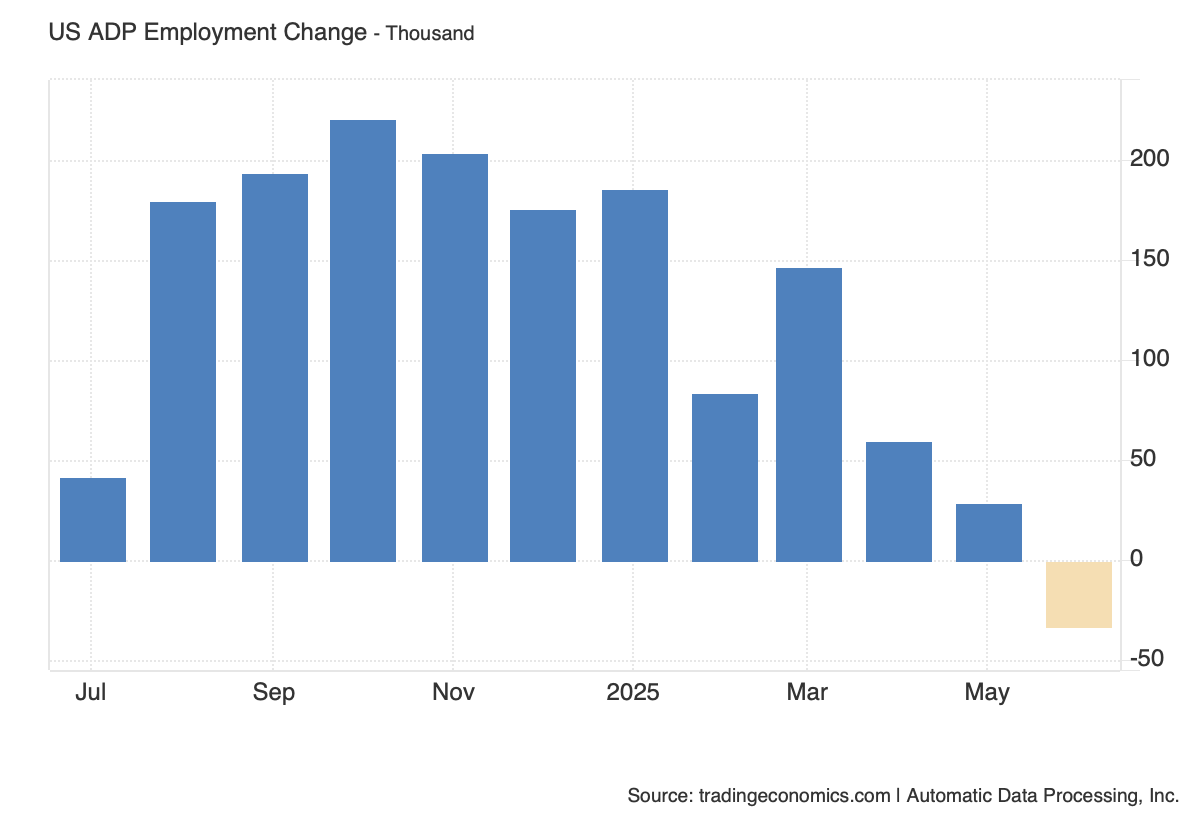

Private businesses in the United States unexpectedly cut 33,000 jobs in June 2025, marking the first net decline in employment since March 2023 and sharply undercutting market forecasts of a 95,000-job gain, according to the latest ADP National Employment Report.

The US economy contracted at an annualized rate of 0.5% in the first quarter of 2025, marking the first quarterly decline in real GDP in three years and a sharper drop than the previously estimated 0.2% contraction.

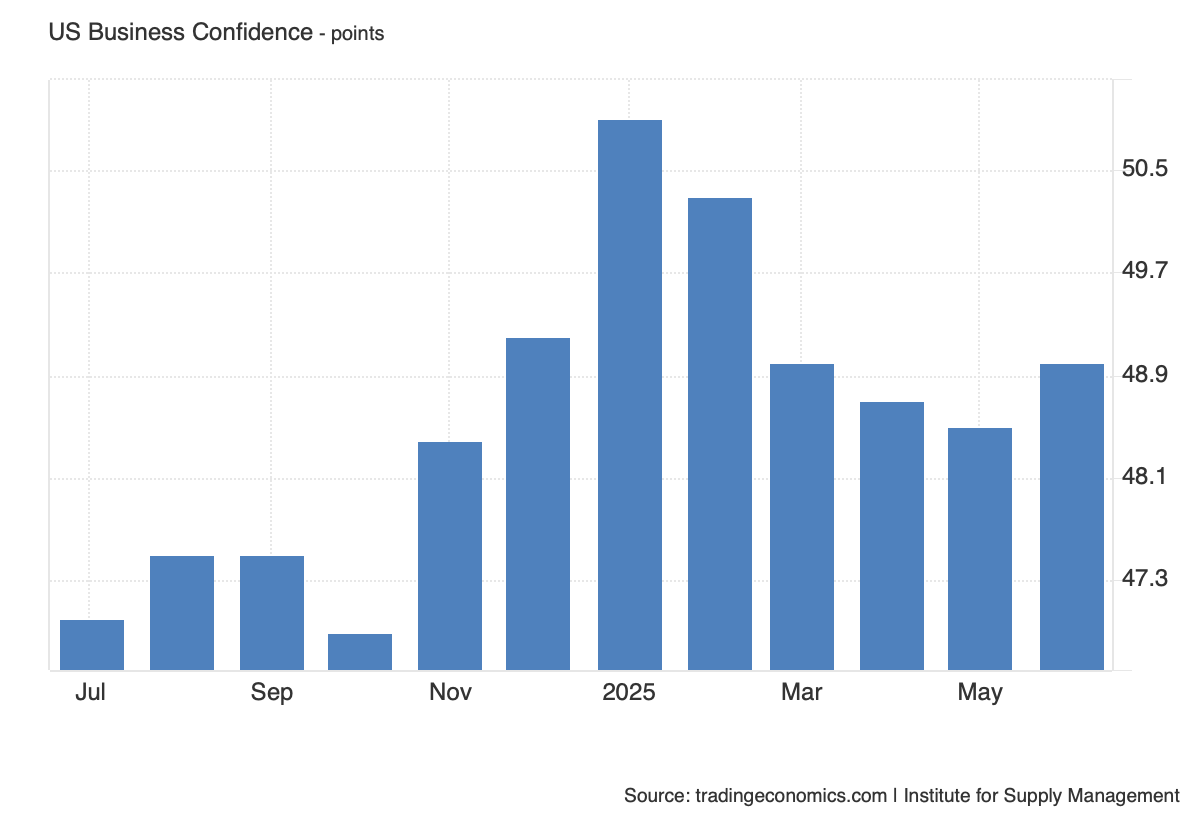

The US manufacturing sector continued to contract in June 2025, according to the latest data from the Institute for Supply Management (ISM), with the Manufacturing Purchasing Managers’ Index (PMI) ticking up modestly to 49.0 from 48.5 in May.

US equity markets posted modest gains on Thursday as investors balanced weaker macroeconomic signals with renewed speculation about an earlier-than-expected shift in Federal Reserve policy.

Saudi Arabia’s trade surplus fell to SAR 14.2 billion (USD 3.78 billion) in April 2025, marking a sharp 62% year-on-year decline from SAR 37.0 billion in April 2024.

The yield on India’s 10-year government bond (G-Sec) declined to 6.35% on Wednesday, reversing part of its brief climb to 6.4% on June 23rd.

The S&P/ASX 200 Index finished virtually unchanged at 8,559 on Wednesday, stabilizing after a strong 1% gain in the prior session, as investors absorbed a surprisingly soft inflation report and renewed hopes for monetary easing by the Reserve Bank of Australia (RBA).

The US dollar index (DXY) extended its recent downward trend on Wednesday, trading below 98 for the third consecutive session. The retreat reflects a confluence of softening haven demand due to tentative geopolitical calm.

Crude oil prices staged a modest recovery on Wednesday, with WTI crude futures rising above $65 per barrel, snapping a two-day rout that had erased nearly 13% in value.

Wall Street closed a jittery week with its third straight equity loss as investors struggled to reconcile an increasingly dovish signal from parts of the Federal Reserve with fresh geopolitical flash-points in the Middle East.

This op-ed uses Steve Jobs’ “bicycles for the mind” to explain what AI is missing: a public interface to power, shared standards, and disciplined human use. It also situates the SLC AI Agent (VEPC, Melbourne) as a case of AI designed to support reasoning rather than generate slop.

AI adoption is not stalling; it is bifurcating. Capital and compute are scaling rapidly, while measurable enterprise value and productivity gains lag. Hyperscaler capex and GPU revenues confirm the installation phase is in full flight. Firm surveys show usage doubling, yet the share reporting material EBIT impact is stuck. Our employment-weighted sector DiD finds no statistically significant post-2022 productivity lift in high-exposure industries. Monetisation should inflect when three conditions hold: inference costs fall by another order of magnitude, evaluation and guardrail stacks standardise, and firms rebuild workflows so AI transforms processes rather than isolated tasks. Until then, value will stay concentrated with infrastructure providers and the few firms that have already re-engineered for AI. Patience is warranted; discipline on governance, cost curves and ROI thresholds is essential.

In May 2025, a data error in the UK’s inflation release offered a rare case to study how markets respond to incorrect economic news and its later correction. On 21 May 2025, the ONS announced that consumer price index (CPI) inflation had jumped to 3.5% in April, up sharply from 2.6% in March. This headline figure overshot market expectations (consensus ~3.3%) and even the Bank of England’s forecast (~3.4%), signaling a surprise uptick in price pressures.

The United Kingdom’s official statistical system was shaken by revelations that critical economic data had been calculated using incorrect inputs, leading to inaccuracies in key indicators. The Office for National Statistics (ONS) – the UK’s national statistical agency – uncovered a methodological error in the price data used for GDP calculations, raising concerns that GDP growth figures for recent years were off-target.

Global trade liberalization has been a driving force in shaping economic outcomes over the past decade. Between 2017 and 2025, countries experienced significant changes in trade policy –making this period ideal for studying the impact of liberalization. In this analysis, we construct a comprehensive country-level panel dataset to examine how reducing trade barriers affects trade flows, GDP growth, and employment.

This framework outlines a comprehensive approach to analyzing global trade liberalization from 2017 to the present. It covers the key datasets needed (with sources), suitable econometric models, data preparation steps, and solutions for missing data and comparability issues.

The period from 2017 to 2024 has been tumultuous for global trade. After decades of steady liberalization, a wave of protectionism and trade tensions emerged, epitomized by tariff wars and rising barriers. At the same time, many countries pushed forward with new trade agreements and reforms to keep markets open.

Australia faces a pivotal choice in crafting its future low-carbon energy strategy: whether to pursue nuclear power, double down on solar energy, or some combination of both. This report provides a rigorous political and economic comparison of nuclear and solar energy options for Australia

This article investigates algorithmic decay—the degradation of model and strategy performance over time—in economics and finance. Using panel regressions with time-varying coefficients, structural break tests, Kalman filters, survival analysis, concept drift detection, and difference-in-differences methods, it demonstrates that algorithmic models experience statistically significant decay if not adapted. Empirical results across macroeconomic forecasting, financial trading, and behavioral interventions confirm decay’s prevalence and quantify its economic costs. Adaptive strategies, such as drift detection and model retraining, substantially mitigate decay. The paper argues that recognizing and managing algorithmic decay should become standard practice in economic modeling, similar to handling heteroskedasticity or autocorrelation.

This report compares housing-market dynamics, affordability trends, and policy responses in Canada, Australia, the United Kingdom, and the United States over 1995–2025. It integrates original econometric evidence—hedonic price regressions, cointegration/error-correction models, VAR impulse analyses, quasi-experimental policy evaluations, and spatial spill-over estimates—built on OECD, IMF, national-statistical, Zillow and CoreLogic datasets.

Over the past two centuries, tariff policies have shifted from high protectionism to widespread liberalization. Early tariffs supported industrial growth, but the Smoot-Hawley Tariff (1930) worsened the Great Depression, leading to post-WWII reductions under GATT. By the late 20th century, tariffs in advanced economies fell to historic lows, driving global trade expansion. While occasional trade wars and protectionist measures persist, historical trends show that lower tariffs have been key to economic growth and global integration.

This report provides a comprehensive econometric analysis of tariffs over the past 200 years, examining their historical evolution, impact on global trade, consumer sentiment, inflation, and sectoral dynamics. Key case studies include the role of tariffs in industrialization, the Smoot-Hawley Tariff’s impact during the Great Depression, modern trade conflicts like the U.S.-China trade war, and sector-specific effects on industries such as manufacturing, agriculture, and automotive. The analysis integrates historical data, econometric models, and empirical findings to quantify the costs and benefits of tariffs in capitalist economies.

The concept of plant intelligence first captured my interest through Charles Darwin’s pioneering research on plant behavior. In the late 19th century, Darwin—alongside his son Francis—authored “The Power of Movement in Plants” (1880), a groundbreaking work that proposed plants are far more dynamic and purposeful than previously thought.

South Asians have been observed to have a higher susceptibility to cardiometabolic diseases since the 1950s, with early research in Singapore identifying elevated coronary heart disease mortality rates in this group. The trend gained more attention in the 1980s–1990s, particularly with increased South Asian migration to Western countries, prompting ethnicity-based health studies to improve diagnosis and care. Recent data highlights that South Asians are 4–5 times more likely to develop type 2 diabetes and face a 1.7-fold greater risk of coronary heart disease compared to White populations in the US and UK.