UK-India An Economic & Trade Relations (1990–2025): A Comprehensive Analysis

India and the United Kingdom have dramatically expanded their economic ties since 1990. In the early 1990s, bilateral trade was relatively modest – on the order of only a few billion USD – as India was just beginning to liberalize its economy. By the mid-2010s, total goods trade had grown to around $15 billion annually, and by the mid-2020s the inclusion of services trade pushed total bilateral trade to roughly $50 billion per year.

UK–India Free Trade Agreement – Economic Implications & Strategic Impact

The UK–India FTA, finalized in May 2025, represents the largest and most comprehensive bilateral trade agreement for the UK post-Brexit. Slashing tariffs on 90% of UK exports to India and liberalizing services trade, the deal is projected to boost UK GDP by £4.8 billion annually, raise wages by £2.2 billion, and expand bilateral trade by £25.5 billion.

China’s Industrial Profits Fall 1.8% in H1 2025 Amid Deflation and Tariff Pressures

China’s industrial sector remains under stress as profits at large industrial firms declined 1.8% year-over-year in the first half of 2025, reaching CNY 3.44 trillion, according to data released by the National Bureau of Statistics (NBS).

US Stocks Log Fifth Straight Record as Trade Optimism and Earnings Fuel Market Momentum

US equity markets closed the week on a high note, with the S&P 500 rising 0.4% on last Friday, marking its fifth consecutive record close the longest such streak in more than a year.

European Markets Fall as Earnings Disappoint ad Trade Uncertainty Weighs on Sentiment

European equities faced broad-based declines on Friday, with both the STOXX 50 and STOXX 600 falling 0.5% amid investor concerns over disappointing corporate earnings and the lack of clarity on a potential US–EU trade agreement.

UK Consumer Confidence Falls Amid Fears of Inflation and Tax Hikes (July 2025)

The United Kingdom’s consumer sentiment weakened in July 2025 as households began bracing for potentially adverse fiscal conditions. According to the GfK Consumer Confidence Index, sentiment edged down to -19 from -18 in June, interrupting a six-month upward trend and indicating a renewed sense of caution.

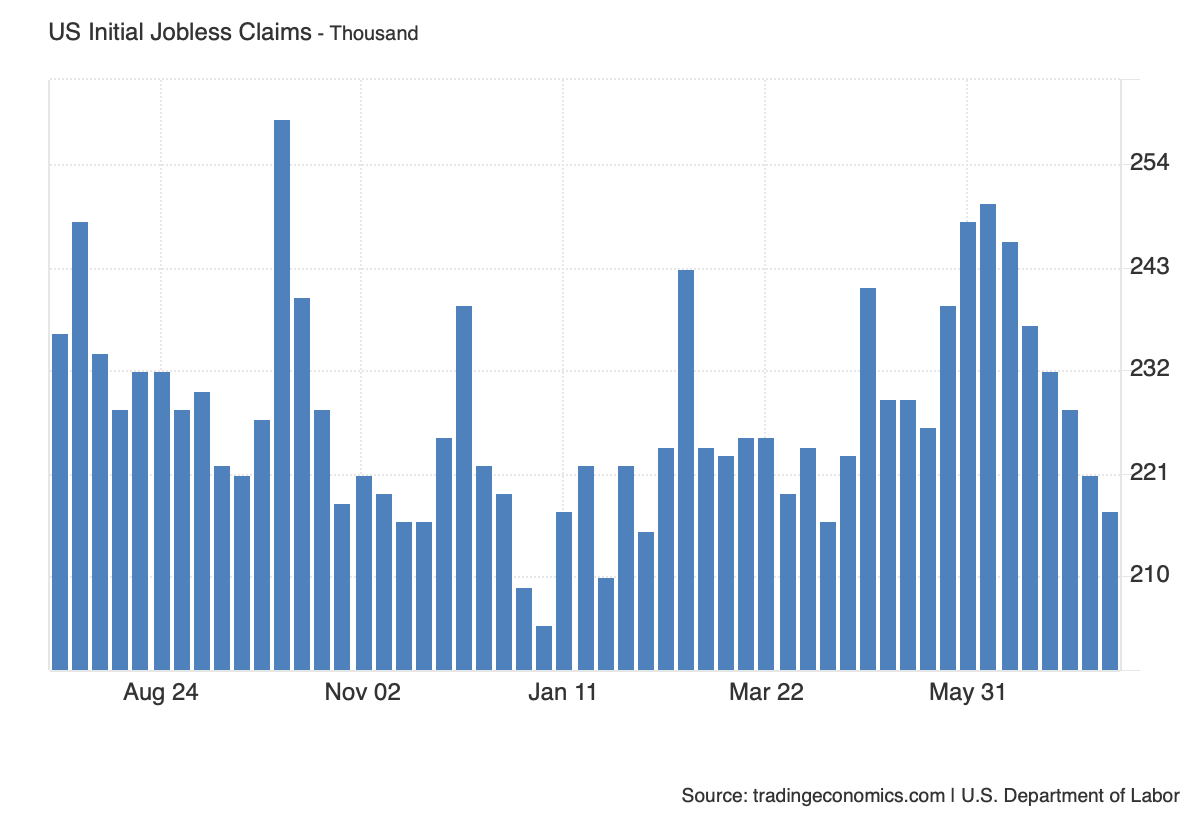

US Jobless Claims Dip Again, but Continued Claims Signal Softening Labor Market

Initial jobless claims in the United States fell to 217,000 in the week ending July 19, 2025, marking a decline of 4,000 from the previous week and defying market expectations, which had forecast a rise to 227,000.

India’s Manufacturing Sector Surges to 17-Year High in July 2025: HSBC PMI Hits 59.2

India’s manufacturing sector surged forward in July 2025, with the HSBC India Manufacturing Purchasing Managers’ Index (PMI) climbing to 59.2, up from 58.4.

Crude Oil Prices Rise as Trade Optimism and Supply Risks Support Market

West Texas Intermediate (WTI) crude futures rose above $66 per barrel on Friday, continuing their upward momentum for a second consecutive session amid growing optimism surrounding global trade negotiations and renewed concerns about supply-side disruptions.

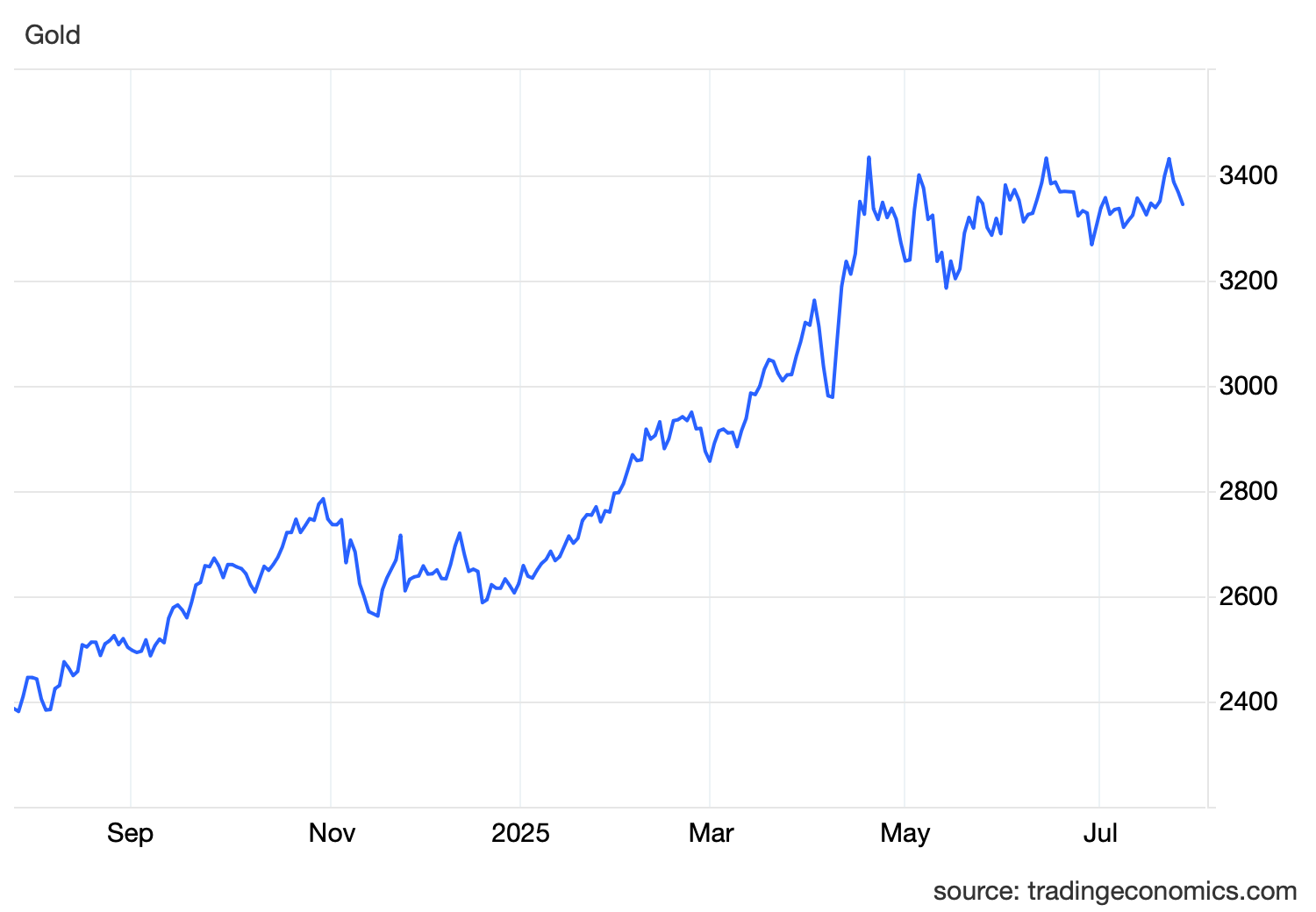

Gold Prices Retreat Amid Trade Optimism and Strong Labor Data, but Weekly Gains Persist

Gold prices declined to approximately $3,360 per ounce on Friday, marking the third consecutive session of losses and reflecting a notable shift in investor sentiment.

Wall Street Futures Edge Higher as Tech Rally, Retail Strength, and Policy Divergence Shape Market Sentiment

U.S. stock futures nudged higher early Friday after Wall Street ended Thursday’s session with broad-based gains, led by record closes in both the S&P 500 and the Nasdaq Composite.

UK Inflation Rises to 3.6% in June 2025, Surpassing Expectations Amid Fuel and Food Price Surge

The UK’s annual inflation rate accelerated to 3.6% in June 2025, according to the latest figures from the Office for National Statistics (ONS), marking the highest level since January 2024 and surprising markets that had expected the rate to remain steady at 3.4%.

Australian Dollar Retreats Ahead of Key Inflation Data Amid Policy Uncertainty and Trade Developments

The Australian dollar weakened further on Friday, falling to around USD $0.658, extending the losses from the previous session as markets turned cautious in anticipation of crucial domestic inflation data scheduled for release next week.

China’s Exports Rise 5.8% in June 2025, Beating Forecasts Amid Rare-Earth Breakthrough and Easing Tariff Pressure

China’s export sector posted stronger-than-expected growth in June 2025, with outbound shipments rising by 5.8% year-on-year to USD 325.2 billion, slightly above consensus forecasts of a 5.0% increase.

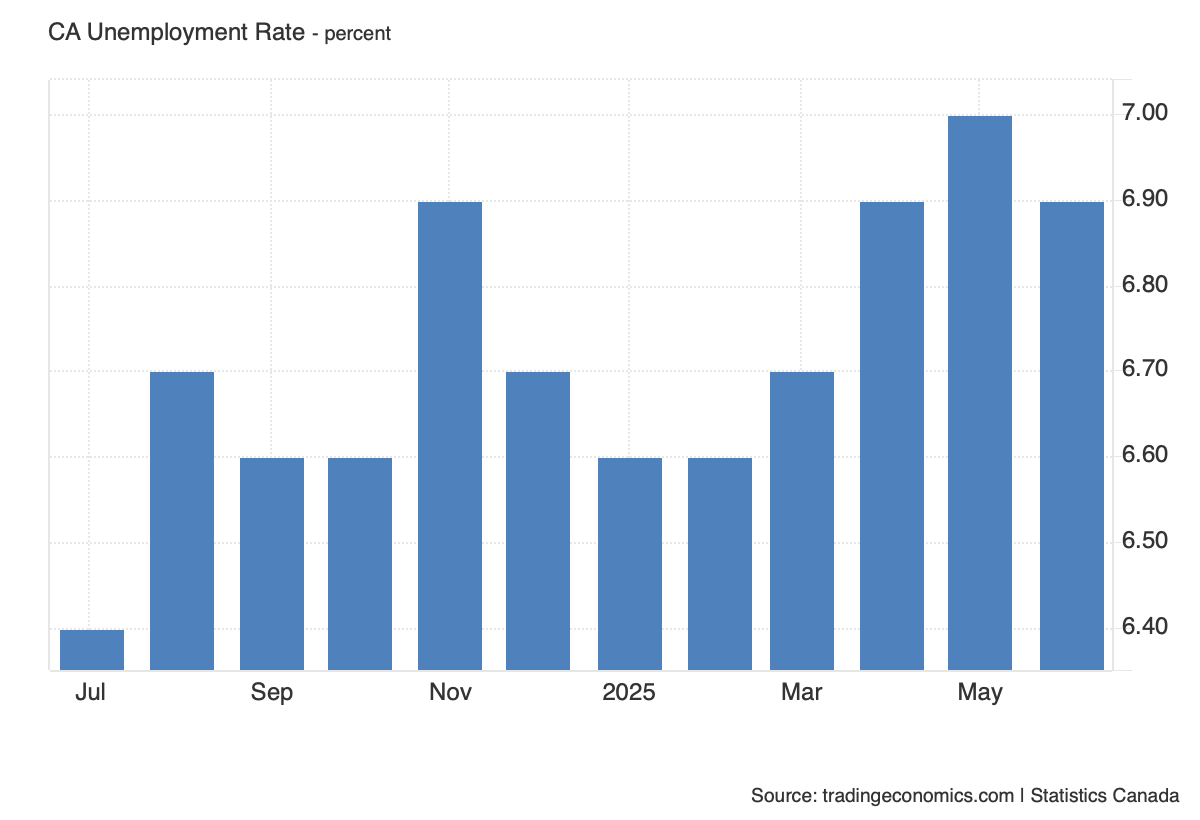

Canada’s Unemployment Rate Unexpectedly Falls to 6.9% in June 2025, Easing Labor Market Concerns Amid Tariff Pressures

Canada’s labor market showed an unexpected sign of resilience in June 2025, as the national unemployment rate edged down to 6.9% from 7.0% in May, breaking a five-month streak of deterioration and defying market expectations of a further increase to 7.1%.

US Copper Futures Surge 10% Amid 50% Tariff Threat, Raising Supply Chain and Refining Concerns

Copper futures in the United States surged to $5.5 per pound on Friday, easing slightly from the intraday record high of $5.7 but still closing nearly 10% above Monday’s level.

Brent Crude Falls to $69.2 Amid Tariff Fears and OPEC+ Output Hike, Offset by Geopolitical Tensions

Brent crude oil futures declined to $69.2 per barrel on Tuesday, easing from a two-week high as markets digested a complex mix of bearish trade policy signals and supply-side developments.

Japan’s Household Spending Surges 4.7% in May 2025, Fastest Growth in Nearly Three Years on Stimulus-Driven Rebound

Japan’s household spending jumped by 4.7% year-on-year in May 2025, marking the strongest expansion since August 2022 and sharply reversing the marginal 0.1% contraction recorded in April.

US Stock Futures Climb as Strong Jobs Data and Fiscal Hopes Lift Sentiment Despite Trade Tensions

US stock futures edged higher on Thursday, with contracts tied to the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all up by 0.3%, as investors digested fresh labor market data that reaffirmed the resilience of the US economy.

Uranium Futures Retreat to $71 Amid Easing Fund Activity and Utility-Driven Repricing, Despite Long-Term Supply and Policy Tailwinds

Uranium futures in the United States fell to $71 per pound, retreating from a seven-month high of $79 reached on June 27th.