UK Consumer Confidence Falls Amid Fears of Inflation and Tax Hikes (July 2025)

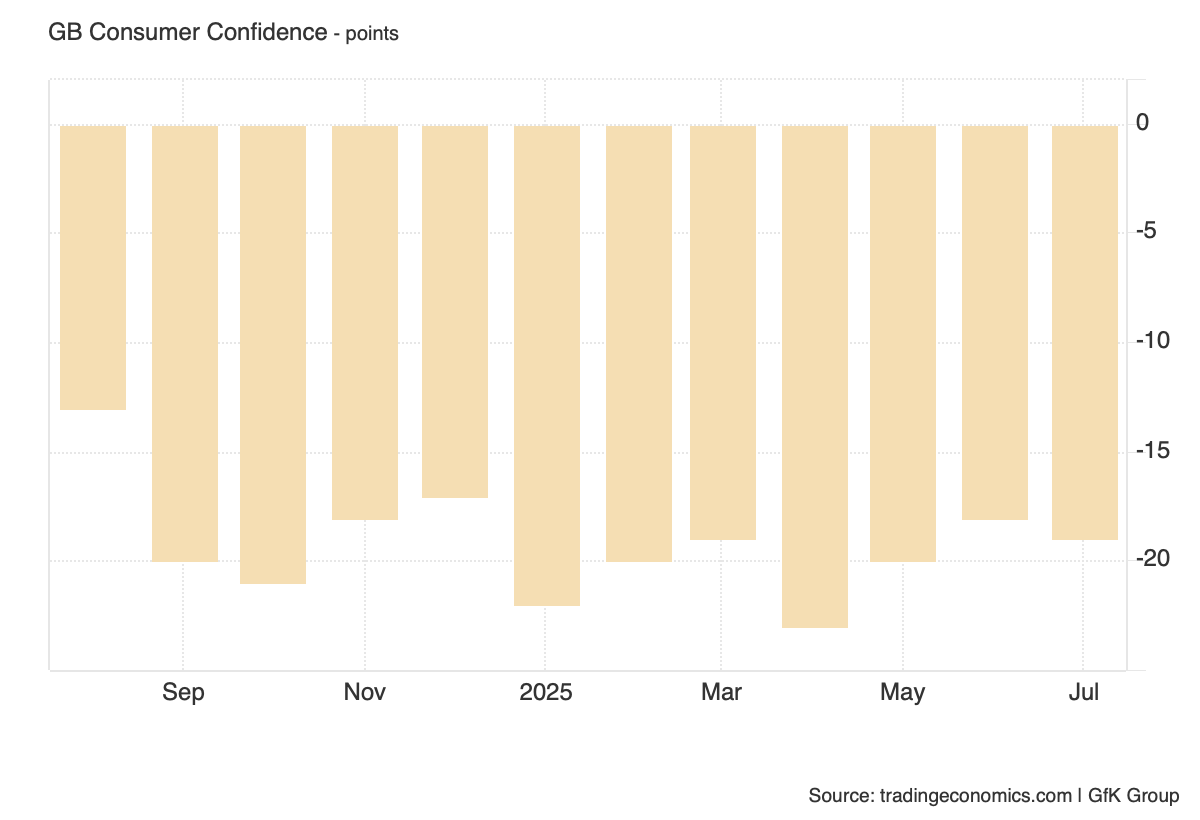

The United Kingdom’s consumer sentiment weakened in July 2025 as households began bracing for potentially adverse fiscal conditions. According to the GfK Consumer Confidence Index, sentiment edged down to -19 from -18 in June, interrupting a six-month upward trend and indicating a renewed sense of caution. While the numerical decline may appear marginal, the broader signal is that consumers are growing uneasy in the face of persistent inflation and increasing speculation about tax hikes in the upcoming Autumn Budget. These concerns, combined with a reversal in welfare spending cuts previously proposed by Prime Minister Keir Starmer, have contributed to a more defensive posture among households.

One of the clearest manifestations of this shift is the surge in savings. The GfK Savings Index rose sharply by 7 points to +34 in July, marking its highest level since November 2007—just before the onset of the global financial crisis. This uptick reflects a significant behavioural pivot, with consumers prioritising financial resilience over discretionary spending. As GfK’s Consumer Insights Director Neil Bellamy observed, “some people may be sensing stormy conditions ahead.” This is corroborated by weakening forward-looking indicators: expectations for personal finances and the general economic outlook over the next 12 months both declined by 2 points each, while the major purchase index dropped to -30. Such figures portend slowing consumer demand in the near term.

The July sentiment downturn also aligns with heightened uncertainty surrounding fiscal policy. Finance Minister Rachel Reeves is expected to announce further tax increases in her second consecutive budget, a move that has already triggered cautious responses in consumer behaviour. The Starmer government’s reversal on planned welfare cuts—originally intended to reduce the fiscal deficit—has compounded expectations that middle-income households may shoulder a greater tax burden. While the government aims to balance fiscal responsibility with social equity, the near-term effect appears to be increased anxiety among the public about their disposable incomes and future economic security.

The UK’s consumer dynamics now stand in contrast to its European and American peers. In July 2025, France and Germany reported stable or even rising consumer sentiment. Eurostat’s latest CPI data show inflation easing to 2.1% in France and 2.3% in Germany, significantly lower than the UK’s 3.4% as per the Office for National Statistics (ONS). Similarly, the US Conference Board Consumer Confidence Index recorded a 0.9-point increase, indicating more resilient sentiment across the Atlantic. This divergence suggests that the UK’s confidence drop is not merely part of a global trend but reflects country-specific fiscal and inflationary pressures.

Empirical projections based on this behavioural pivot suggest a likely uptick in the UK household savings ratio, which stood at 7.1% in Q2 and is now forecast to climb to 8.4% by Q4 2025. Retail sales volumes are expected to contract by approximately 0.6% quarter-on-quarter in Q3, particularly in discretionary categories such as travel, household goods, and non-essential services. These consumption trends may contribute to a slowdown in GDP growth, with estimates for Q3 revised downward to 0.1%, compared to 0.3% in Q2. The outlook for the second half of 2025 remains clouded by uncertainty regarding the timing and scale of the proposed fiscal adjustments.

From a policy standpoint, the July data highlights the delicate balance facing the UK government. Austerity-style tax increases without targeted relief or parallel growth-oriented measures may suppress consumer demand and impede the recovery. Policymakers may need to consider more progressive tax designs that limit the burden on median-income earners while maintaining revenue targets. On the corporate side, sectors reliant on discretionary consumer spending—such as retail, hospitality, and automotive—should brace for softer demand. Conversely, financial institutions may benefit from increased deposit flows and higher demand for fixed-income products as consumers seek capital preservation.

In summary, July’s fall in UK consumer confidence reflects not just a numerical shift in sentiment but a deeper behavioural recalibration. The combination of expected fiscal tightening, persistent inflation, and reversals in social spending commitments is leading households to act more defensively. With inflation still above target and a potentially contractionary budget on the horizon, confidence could erode further unless mitigated by clear, equitable, and growth-supportive fiscal strategies. Businesses, investors, and policymakers would do well to monitor this pivot closely, as it may shape the UK’s macroeconomic trajectory into 2026.

References

Bellamy, N. (2025) GfK Consumer Confidence Barometer – July 2025. GfK UK.

Office for National Statistics. (2025) Consumer Price Index Time Series. [https://www.ons.gov.uk]

HM Treasury. (2025) Budget and Forecast Reports. [https://www.gov.uk/government/organisations/hm-treasury]

Institute for Fiscal Studies. (2025) Fiscal Outlook – Mid-Year Update. [https://ifs.org.uk]

Eurostat. (2025) Harmonised Index of Consumer Prices – July Release. [https://ec.europa.eu/eurostat]

Conference Board. (2025) US Consumer Confidence Survey. [https://conference-board.org]