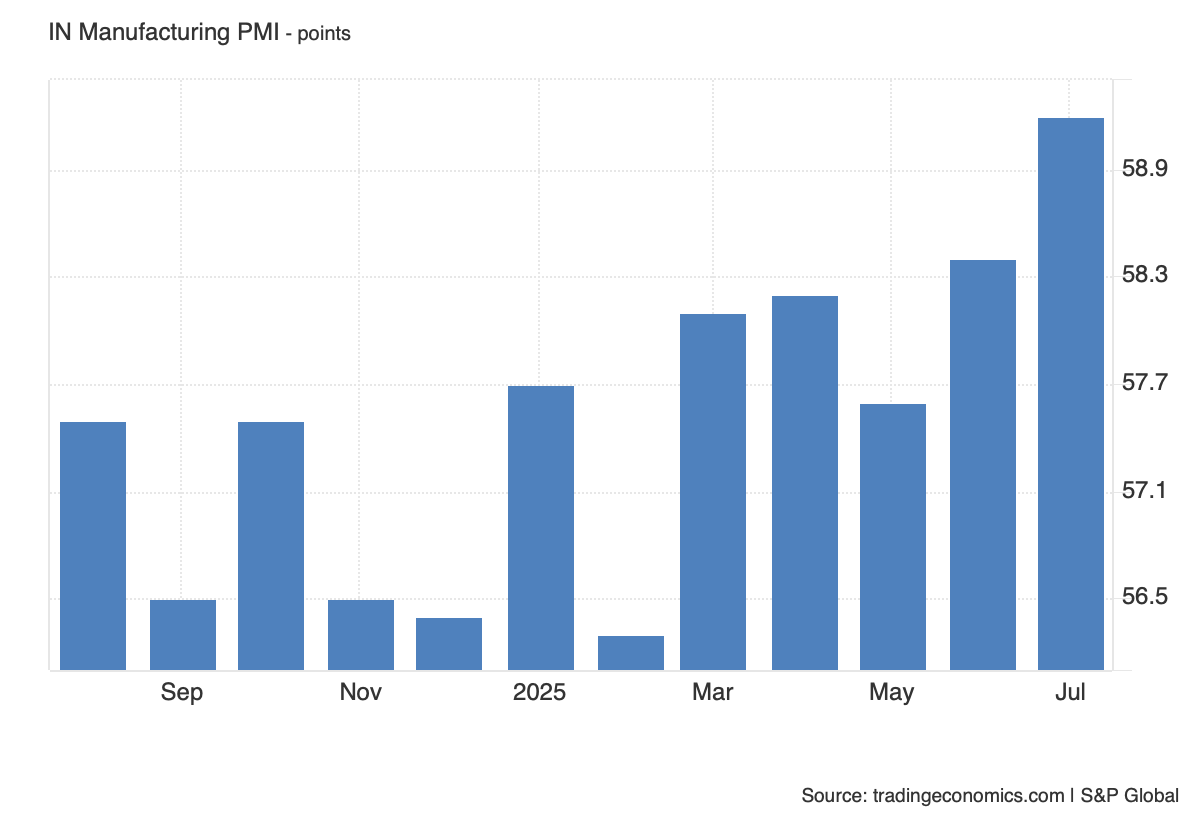

India’s Manufacturing Sector Surges to 17-Year High in July 2025: HSBC PMI Hits 59.2

India’s manufacturing sector surged forward in July 2025, with the HSBC India Manufacturing Purchasing Managers’ Index (PMI) climbing to 59.2, up from 58.4 in June, according to preliminary data released by S&P Global. This latest reading marks the highest PMI level since early 2008, signaling the strongest improvement in manufacturing conditions in over 17 years. A PMI above 50 denotes expansion, and the July print reflects a sharp and sustained upturn in output, fueled by domestic demand resilience, improved supply-side conditions, and pricing power that remains intact despite global headwinds.

The robust expansion in manufacturing activity was primarily driven by strong growth in both output and new orders. Manufacturers reported a substantial influx of domestic orders, indicating that India’s internal economic momentum remains buoyant amid global uncertainties. Although new export orders also rose, the pace of international demand growth moderated slightly from June, suggesting some softening in external markets. This trend aligns with recent global PMI readings, which show a gradual deceleration in manufacturing demand across the Eurozone, East Asia, and North America, likely reflecting currency volatility, rising trade frictions, and delayed inventory restocking cycles abroad.

Despite this marginal export softness, Indian manufacturers continued to increase purchasing activity at a sharp pace in July. The report noted that firms built up input inventories aggressively, capitalising on improving supplier delivery times and aiming to hedge against future price pressures or potential supply disruptions. This strategic stockpiling suggests confidence in sustained order flows over the next few months. Supplier delivery times shortened further, indicative of easing logistical bottlenecks and greater supply chain reliability—factors that had previously constrained Indian manufacturers in the post-pandemic recovery phase.

However, this increase in input purchases was not matched by similar expansions in inventories of finished goods. Instead, manufacturers reported drawing down existing stocks to fulfill the strong rise in demand. This inventory depletion signals both strong consumer uptake and perhaps some lag in adjusting final output to the rising order pipeline. It may also reflect an emphasis on just-in-time inventory practices, especially in sectors such as auto components, pharmaceuticals, and consumer durables, which continue to prioritise lean inventory management amidst volatile input prices.

Pricing dynamics in July were notably firm. The PMI report highlighted a renewed acceleration in output charge inflation, indicating that producers passed on higher costs to customers more aggressively than in previous months. This reflects improved pricing power amid tight demand-supply conditions. The current price pass-through appears supported by resilient end-consumer demand and is not yet triggering demand destruction—though this balance will be closely monitored in coming quarters. The cost side of inflation, meanwhile, remained manageable, with the report noting only modest increases in input prices, partly due to lower global crude and metal prices relative to 2022–23 peaks.

From a sectoral lens, capital goods and intermediate goods segments led the manufacturing upturn, supported by rising public and private sector investment. Infrastructure, construction-related manufacturing, and electrical equipment categories saw above-average activity, while the textiles and apparel sectors reported more modest growth amid subdued export demand. The divergence in performance across sectors reinforces the dual-track recovery: domestic-facing industries are thriving while export-facing firms face challenges stemming from weaker global growth and currency misalignments.

The strong PMI performance in July comes amid a broader economic narrative of India outperforming its peers in the Global South. With projected real GDP growth of 6.6% for FY2025–26 (IMF, 2025), India’s manufacturing momentum offers a structural offset to ongoing global trade and capital volatility. Moreover, the PMI reading supports Reserve Bank of India (RBI) forecasts that core industrial output will remain robust, especially if capital expenditure by both government and corporate actors sustains its current trajectory. These trends also enhance India’s position as a nearshoring destination for global firms reassessing supply chain risks out of China.

Looking forward, HSBC’s report suggests that manufacturing strength is likely to persist into Q3 2025. However, a few caution flags remain. First, the continued moderation in export order growth could weigh on momentum if global trade conditions worsen further. Second, rising output prices—if not counterbalanced by income growth or inflation moderation—could compress real purchasing power and curb domestic demand. Lastly, geopolitical risks in commodity and shipping markets, particularly in the Red Sea and Taiwan Strait regions, could reignite input cost volatility, thereby affecting profit margins and output planning.

In summary, the July 2025 HSBC India Manufacturing PMI presents a picture of strength underpinned by strong domestic demand, input-side resilience, and pricing power. While external uncertainties remain, India’s manufacturing ecosystem is demonstrating agility and depth not seen in over a decade. As the country continues to navigate a complex global landscape, this manufacturing surge provides both a growth anchor and a policy tailwind as the government and central bank prepare for the next phase of economic management.

Sources

S&P Global. (2025). HSBC India Manufacturing PMI – Preliminary July 2025 Release. [https://www.pmi.spglobal.com]

Reserve Bank of India. (2025). Monetary Policy Report – June 2025. [https://www.rbi.org.in]

International Monetary Fund. (2025). World Economic Outlook Update – July 2025. [https://www.imf.org]

Ministry of Commerce and Industry, India. (2025). Monthly Export Performance Summary – June 2025. [https://commerce.gov.in]