US Copper Futures Surge 10% Amid 50% Tariff Threat, Raising Supply Chain and Refining Concerns

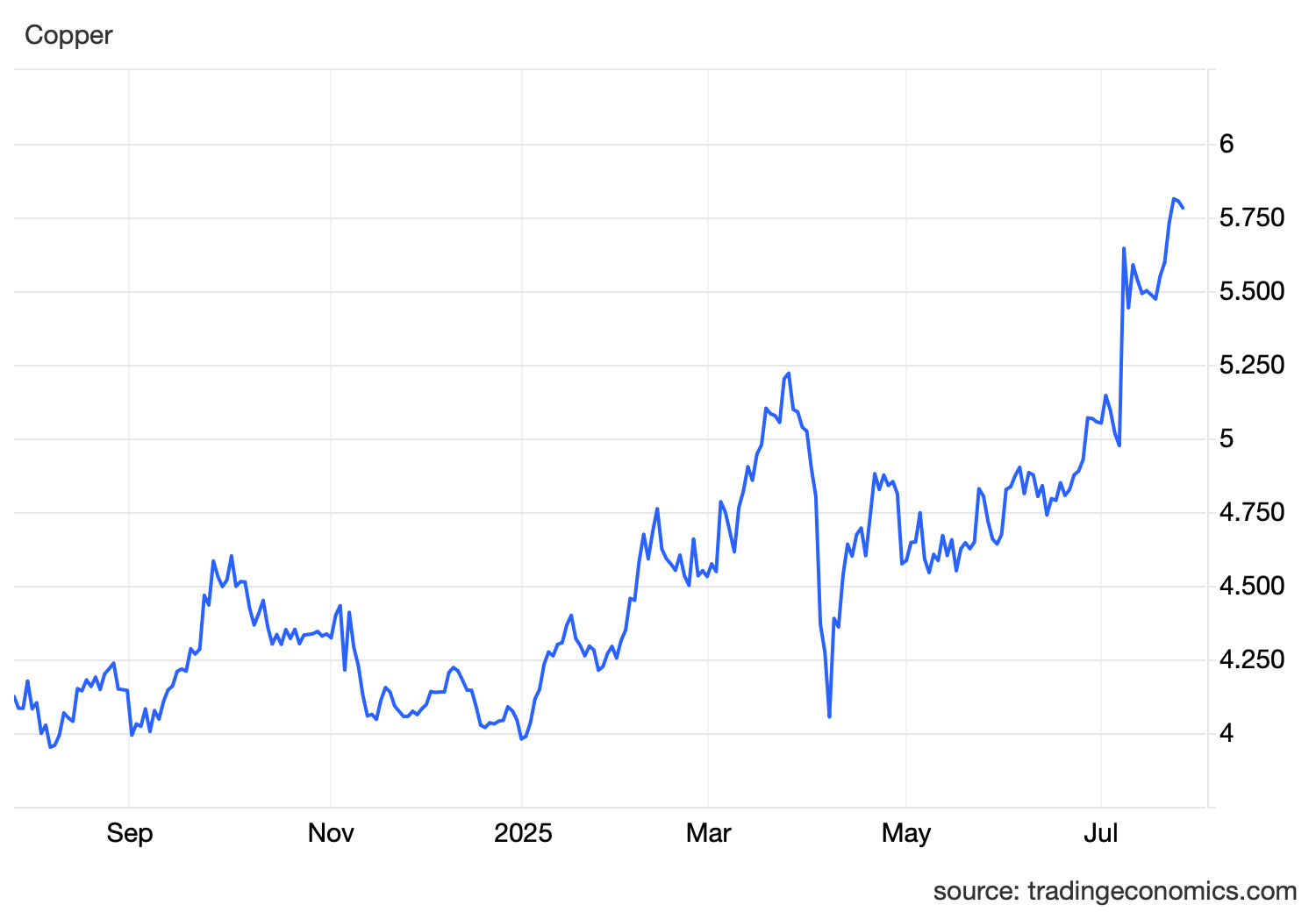

Copper futures in the United States surged to $5.5 per pound on Friday, easing slightly from the intraday record high of $5.7 but still closing nearly 10% above Monday’s level. The sharp rally was triggered by President Donald Trump’s announcement that copper will be subjected to a 50% import tariff, following the conclusion of recently unveiled tariffs on pharmaceutical imports. Although the White House did not disclose specific implementation timelines, grace periods, or metal grade distinctions, the market reacted swiftly—pricing in potential supply disruptions, rising input costs, and logistical bottlenecks within the U.S. copper value chain.

The policy announcement has had immediate ramifications in the physical and futures markets. The premium between US-traded copper futures and London Metal Exchange (LME) copper widened dramatically to 25%, a record differential that highlights the regional distortion now impacting copper pricing. While LME prices edged lower due to broader base metal weakness and declining Chinese industrial demand, U.S. copper markets have been thrown into turmoil by supply risk speculation and aggressive pre-tariff positioning. This price divergence reflects not only the tariff impact but also a reversal in copper stockpile dynamics: traders, who had been building inventories in the U.S. since February in anticipation of possible tariffs, are now shifting to rapid offload strategies before the policy takes effect.

From a structural standpoint, the proposed 50% tariff introduces significant vulnerabilities into the U.S. copper ecosystem. The United States is not a major producer of copper ore, and its refining capacity is limited—currently hosting only two operating copper smelters. Domestic mine output, while stable, is far below the volume required to meet industrial demand across the construction, electronics, renewable energy, and defense sectors. According to data from the U.S. Geological Survey (USGS), U.S. copper mine production totaled just 1.2 million metric tons in 2024, while consumption needs exceeded 1.8 million metric tons. The shortfall is largely met through imports of refined copper and copper concentrate from countries such as Chile, Peru, Canada, and Mexico—many of which could fall under the proposed tariff regime.

If the tariffs are imposed without exemptions for intermediate goods (such as blister copper or copper cathodes used in wiring and manufacturing), U.S. refiners and fabricators may face serious cost escalations. In addition, the two domestic smelters—both of which are over three decades old—would struggle to handle increased throughput without substantial upgrades or external support. This creates a scenario where upstream supply constraints collide with downstream demand rigidity, particularly in sectors like EV manufacturing and grid modernization that rely heavily on high-purity copper.

Moreover, this move complicates the Biden administration’s earlier clean energy goals, which require substantial copper for electric vehicle infrastructure, battery systems, and renewable grid integration. A prolonged price premium in U.S. copper could disincentivize investment in copper-intensive projects or lead to inflationary pressures across green technology supply chains. For industries that rely on long-term procurement contracts, the potential 50% tariff introduces both pricing opacity and operational risk.

From a global trade perspective, the tariff adds another layer of uncertainty to already tense trans-Pacific and trans-Atlantic relations. Copper-exporting countries may seek alternative buyers in Asia or Europe, particularly as LME prices trend downward and Chinese demand softens. Simultaneously, the U.S. could find itself in a bottlenecked import environment, where available global supply is unwilling or unable to meet its demand at acceptable margins. Such outcomes could distort copper flows, encourage circumvention via trans-shipment through tariff-exempt countries, and strain the monitoring capacity of U.S. Customs and Border Protection.

Looking ahead, commodity analysts expect significant volatility in U.S. copper markets over the next quarter. If the tariff is implemented in full scope, futures prices could rise another 10–15% in Q3 due to panic buying and refinery bottlenecks. However, if the policy includes exemptions for certain copper grades or concentrates, or if implementation is delayed beyond the presidential election cycle, prices could stabilize near the $5.2–$5.4 range. Spot market participants are also watching for potential strategic stockpile releases or coordinated diplomacy between the U.S. and Latin American producers.

In conclusion, the sharp rally in U.S. copper futures underscores the market’s sensitivity to geopolitical shocks and policy uncertainty. While tariffs may be designed to protect or incentivize domestic industry, in the case of copper—a strategically essential, import-dependent commodity—the immediate effect is likely to be inflationary, supply-constricting, and operationally destabilizing. As the global copper market adjusts to this evolving U.S. trade stance, stakeholders across manufacturing, energy, and construction sectors will need to brace for higher costs, tighter inventories, and a recalibrated global supply chain.

Sources

U.S. Geological Survey. (2025). Mineral Commodity Summary – Copper. [https://www.usgs.gov]

CME Group. (2025). Copper Futures Market Activity – July 2025.

London Metal Exchange. (2025). LME Copper Price Dashboard. [https://www.lme.com]

Bloomberg. (2025). Copper Surges as Trump Signals 50% Tariff on Imports.

Reuters. (2025). U.S. Smelters Unprepared for Tariff Shockwave, Say Analysts.

CRU Group. (2025). Copper Market Outlook – Q3 2025 Update.