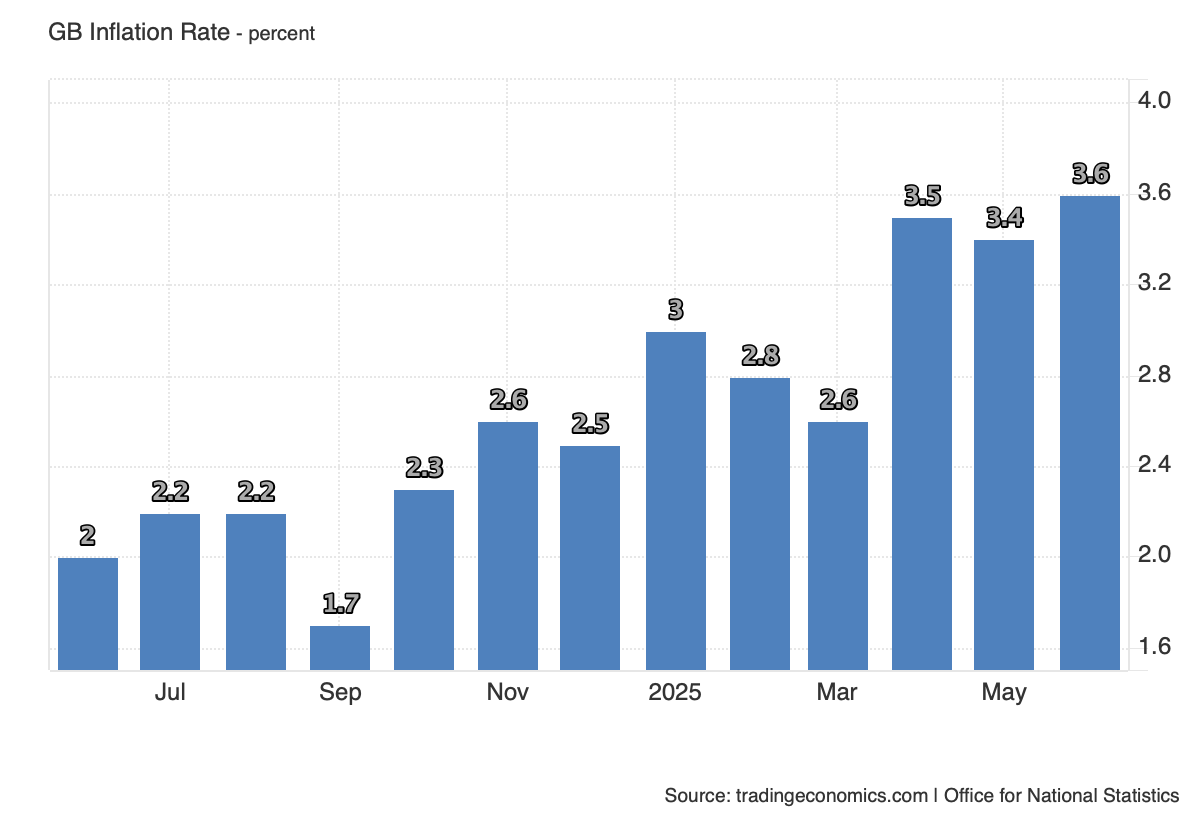

UK Inflation Rises to 3.6% in June 2025, Surpassing Expectations Amid Fuel and Food Price Surge

The UK’s annual inflation rate accelerated to 3.6% in June 2025, according to the latest figures from the Office for National Statistics (ONS), marking the highest level since January 2024 and surprising markets that had expected the rate to remain steady at 3.4%. This unexpected uptick reflects renewed price pressures in key consumer categories—most notably transport and food—and underscores the persistent challenges the Bank of England faces in returning inflation to its 2% target.

The largest upward contribution in June came from the transport sector, where prices rose by 1.7% year-on-year, up sharply from 0.7% in May. Motor fuel costs led the surge, driven by both higher global oil prices and domestic supply constraints. Long-haul and intra-European airfares also rose significantly, reflecting both seasonal travel demand and elevated jet fuel costs. Additional pressure came from rail fares and costs associated with maintenance and repair of personal transport vehicles, indicating that inflation in the transport segment is broad-based and not limited to one mode of mobility.

Food prices added further momentum to the inflation rise, with annual food inflation climbing to 4.5%—the highest since February 2024. Notably, specific items such as cakes and cheddar cheese were highlighted as major contributors to the monthly rise. This reflects both commodity price fluctuations and persistent supply chain challenges in agricultural logistics. In contrast to previous months where vegetable and fruit prices were key drivers, June’s data suggest a shift toward processed food inflation, which tends to be stickier and more persistent due to longer production cycles and margin recovery strategies by manufacturers.

Clothing and footwear also reversed their deflationary trend, rising by 0.5% in June compared to a -0.3% decline in May. This suggests a resurgence of seasonal demand and price normalization as retailers passed through higher input costs and adjusted inventories. The sector had previously benefited from post-COVID discounting cycles and inventory overhang, but the June data reflect a return to more typical pricing dynamics.

On a monthly basis, the headline Consumer Price Index (CPI) rose 0.3% in June, up from a 0.2% increase in May. This month-on-month acceleration aligns with broader inflationary momentum, especially given the 0.4% monthly rise in the core CPI—an index that excludes volatile components like food and energy. The annual core inflation rate also accelerated to 3.7%, indicating that underlying price pressures are not only persisting but broadening across the economy. Core inflation is closely watched by the Bank of England, as it provides a clearer measure of sustained domestic inflationary trends untainted by external shocks.

In contrast, some categories provided minor disinflationary relief. Inflation in housing and utilities eased slightly to 7.5% from 7.7%, and household services (such as cleaning, childcare, and maintenance) also moderated to 6.7% from 6.9%. These decreases, while notable, were not sufficient to offset the broader uptick across goods-related categories. Services inflation, which has remained elevated throughout the past 18 months, held steady at 4.7%, suggesting that wage growth and rent-related pressures continue to exert upward force in the non-tradables sector.

The June inflation figures complicate the monetary policy outlook. Prior to the release, market consensus had priced in the likelihood of a Bank of England rate cut by the fourth quarter of 2025, particularly after several months of moderating inflation. However, the reacceleration in both headline and core inflation introduces a more hawkish bias into the outlook. As of Friday morning, overnight index swaps pushed back expectations for a rate cut to early 2026, with some analysts now speculating that the Monetary Policy Committee (MPC) may need to consider one final hike if inflation expectations become unanchored.

Underlying these developments is the structural question of how much of the UK’s inflation surge is demand-driven versus supply-constrained. While energy price volatility has eased from its 2022–2023 highs, ongoing disruptions in food supply chains (due to both Brexit and climate-related shocks), labor shortages in services, and wage negotiations across public and private sectors all continue to fuel inflation. Moreover, the recently announced U.S. tariff wave—spanning EU, India, and Brazil—could feed into UK import prices indirectly, particularly in energy, machinery, and intermediate goods, amplifying cost-push dynamics in H2 2025.

In summary, the UK’s inflation rebound to 3.6% in June signals a significant deviation from the disinflationary trend observed earlier in the year. While some base effects and seasonality may have influenced the reading, the breadth of the acceleration—across transport, food, clothing, and core categories—raises concerns about the pace at which inflation is retreating. The Bank of England now faces a more constrained decision space, balancing the risk of premature easing against the possibility of over-tightening into a still-fragile recovery. As such, monetary policy over the next quarter is likely to be reactive, data-dependent, and finely tuned to both headline and core inflation dynamics.

Sources

Office for National Statistics (2025). UK Consumer Price Inflation – June 2025 Release. [https://www.ons.gov.uk]

Bank of England (2025). Monetary Policy Report – May 2025. [https://www.bankofengland.co.uk]

Bloomberg Economics (2025). UK Inflation Surprises to the Upside, Rate Cut Bets Fade

Peterson Institute for International Economics (2025). Global Tariffs and Inflation Spillover Effects: Mid-Year Review