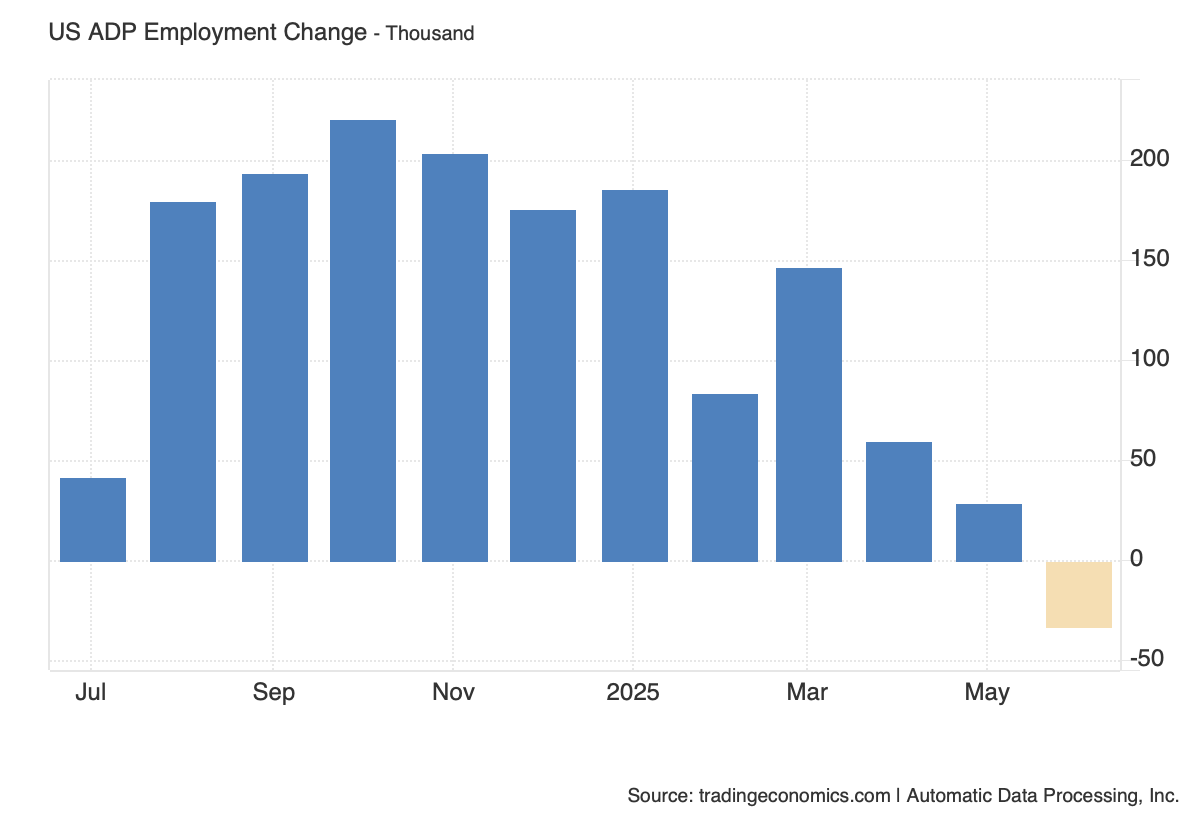

US Private Sector Sheds 33,000 Jobs in June 2025 Amid Hiring Hesitancy in Services Sector

Private businesses in the United States unexpectedly cut 33,000 jobs in June 2025, marking the first net decline in employment since March 2023 and sharply undercutting market forecasts of a 95,000-job gain, according to the latest ADP National Employment Report.

US Economy Contracts 0.5% in Q1 2025: Tariff Fears, Sluggish Consumption, and Export Revisions Weigh on Growth

The US economy contracted at an annualized rate of 0.5% in the first quarter of 2025, marking the first quarterly decline in real GDP in three years and a sharper drop than the previously estimated 0.2% contraction.

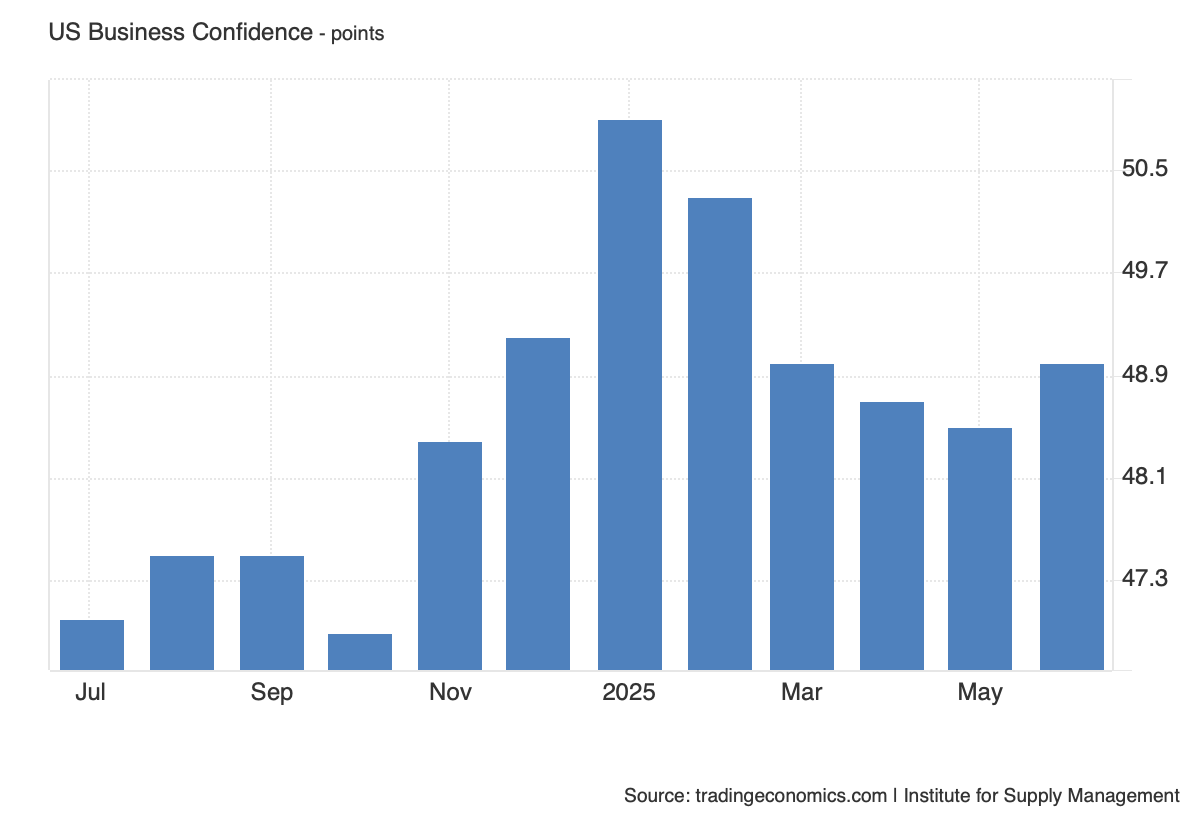

US Manufacturing Contracts for Fourth Straight Month in June, but ISM PMI Shows Slower Decline Amid Tariff Pressures and Production Rebound

The US manufacturing sector continued to contract in June 2025, according to the latest data from the Institute for Supply Management (ISM), with the Manufacturing Purchasing Managers’ Index (PMI) ticking up modestly to 49.0 from 48.5 in May.

US Stocks Edge Higher Amid Fed Pivot Bets and Economic Contraction Signals

US equity markets posted modest gains on Thursday as investors balanced weaker macroeconomic signals with renewed speculation about an earlier-than-expected shift in Federal Reserve policy.

Saudi Arabia’s Trade Surplus Narrows Sharply Amid Oil Export Slump and Rising Import Demand

Saudi Arabia’s trade surplus fell to SAR 14.2 billion (USD 3.78 billion) in April 2025, marking a sharp 62% year-on-year decline from SAR 37.0 billion in April 2024.

India’s 10-Year Bond Yield Falls to 6.35% Amid Low Inflation and Dovish RBI Moves

The yield on India’s 10-year government bond (G-Sec) declined to 6.35% on Wednesday, reversing part of its brief climb to 6.4% on June 23rd.

Australia’s ASX 200 Pauses After Inflation Surprise as Rate Cut Bets Surge

The S&P/ASX 200 Index finished virtually unchanged at 8,559 on Wednesday, stabilizing after a strong 1% gain in the prior session, as investors absorbed a surprisingly soft inflation report and renewed hopes for monetary easing by the Reserve Bank of Australia (RBA).

US Dollar Weakens Below 98 as Geopolitical Risks Ease and Powell Maintains Policy Hold

The US dollar index (DXY) extended its recent downward trend on Wednesday, trading below 98 for the third consecutive session. The retreat reflects a confluence of softening haven demand due to tentative geopolitical calm.

Oil Rebounds to $65 After Sharp Selloff as Geopolitical Stabilization and Supply Draw Support Prices

Crude oil prices staged a modest recovery on Wednesday, with WTI crude futures rising above $65 per barrel, snapping a two-day rout that had erased nearly 13% in value.

Rate-Cut Hopes Collide With Middle-East Risk

Wall Street closed a jittery week with its third straight equity loss as investors struggled to reconcile an increasingly dovish signal from parts of the Federal Reserve with fresh geopolitical flash-points in the Middle East.

“Your Brain on ChatGPT” - A Forensic Takedown

Kosmyna et al.’s “cognitive-debt” alarm collapses under even cursory scrutiny. An 18-person subsample, thousands of uncorrected EEG tests and tool-silo rules that forbid the AI group from normal web use virtually guarantee a result that looks anti-ChatGPT. Yet mainstream neuroscience shows the opposite pattern: lower fronto-parietal activation is a hallmark of neural efficiency as skills consolidate, not a sign of decay. fNIRS and fMRI practice studies chart falling pre-frontal load alongside sharper performance, while longitudinal MRI trials reveal digital training can enlarge grey matter and reorganise functional networks. By conflating strategic memory shifts with impairment, cherry-picking p-values and burying alternative explanations, the paper fashions a dystopia that real biomedical evidence simply does not support.

European Markets Slide on Geopolitical Tensions and Renewable Energy Policy Shift

European equity markets retreated sharply on Tuesday as geopolitical uncertainty surrounding the escalating conflict between Israel and Iran rattled investor confidence.

Gold Price Nears $3,390 as Geopolitical Risks and Fed Policy Shape Market Outlook

Gold prices climbed sharply toward $3,390 per ounce on Tuesday, reversing Monday’s losses and reflecting renewed investor demand for safe-haven assets amid escalating geopolitical tensions in the Middle East.

Dollar Slides Below 98.5 as Tariff Threats and Weak Inflation Data Fuel Market Jitters

The U.S. dollar weakened sharply on Thursday, with the Dollar Index (DXY) falling below 98.5—a level not seen since early 2022—amid escalating trade tensions and mounting expectations of a Federal Reserve rate cut.

Asian Markets Slip as Trump Rekindles Tariff Threats, Raising Trade Tensions Across the Region

Asian equity markets retreated sharply on Thursday following renewed tariff threats from former U.S.

Australian Stocks Hit New Record Amid Trade Optimism and Rate Cut Bets

The Australian benchmark S&P/ASX 200 index rose 0.4% to close at 8,620 on Wednesday.

Australia’s Consumer Sentiment Softens in June as Outlook Weakens

Australia’s consumer confidence posted a marginal gain in June 2025, signaling a sharp slowdown in momentum amid global trade uncertainty and residual household financial strain.

Australia’s 10-Year Bond Yield Steady at 4.31% as RBA Signals Cautious Easing Path

Australia’s benchmark 10-year government bond yield hovered near 4.31% on Tuesday, maintaining its recent range as investors digested the latest monetary policy minutes from the Reserve Bank of Australia (RBA).

How a 0.1% Data Error Shook Confidence in UK Inflation Figures

May 2025, the United Kingdom’s Office for National Statistics (ONS) publicly admitted that it had overstated the official consumer price index (CPI) inflation rate for April. The discrepancy—just 0.1 percentage point, pushing the figure from an actual 3.4% to a reported 3.5%—was caused by incorrect vehicle excise duty (VED) data provided by the Department for Transport.

Eurozone Inflation Falls Below ECB Target, Paving Way for Rate Cut

The Eurozone’s inflation rate fell below the European Central Bank’s target for the first time in eight months, bolstering expectations of a monetary policy rate cut later this week. According to a flash estimate by Eurostat, consumer price inflation in the euro area slowed to 1.9% year-on-year in May 2025, down from 2.2% in April and below consensus forecasts of 2.0%.