A Tumultuous Fortnight: Understanding April 2025’s Trade-War-Driven Market Rout

The S&P 500 lost 10.5 percent in the two trading sessions of 3–4 April, the index’s fifth-largest two-day percentage fall since 1950, wiping roughly US $3 trillion in market capitalisation.

Summary of Foreign & Domestic Investor Activity in Stock Market

Summary of foreign & domestic investor activity in the stock markets of the world’s top 10 economies over the past 14 days.

Supply Chain Disruptions in Top 20 GDP Economies (2025): Quick Overview

Supply chain disruptions are significantly impacting the world’s top 20 economies, driven by escalating trade tensions, geopolitical conflicts, labor shortages, and climate-related events.

How a Single Interest‑Rate Move Echoes Across Prices, Jobs & Currencies

When the Reserve Bank of Australia (RBA) left its cash‑rate target unchanged at 4.10 per cent this month, most mortgage holders breathed a sigh of relief. But the decision reverberates far beyond repayments due on the first of May.

A 30 Day Overview in Financial Markets

Over the past month, international financial markets have undergone significant turbulence, catalyzed by abrupt policy recalibrations in the United States and an intensifying climate of geopolitical volatility.

Global Energy Security & the New Geoeconomic Chessboard

The past three years have redrawn the energy map faster than at any time since the 1970s oil shocks. Russia’s invasion of Ukraine shattered the assumption that pipeline gas is apolitical; U‑S liquefied natural‑gas (LNG) cargoes now meet half of Europe’s LNG demand and more than one‑third of its total gas needs, while the European Union (EU) has cut Russia’s pipeline share from 40% in 2021 to roughly 11% in 2024.

Tax Harmonization vs. Tax Arbitrage in 2025: The Geopolitics, Economics, & High‑Stakes Theories Reshaping Corporate Taxation

In February, the White House instructed the U.S. Trade Representative to explore punitive tariffs against any country that dares levy a unilateral Digital Services Tax (DST) on Big Tech.

Global Inequality & The Gini Gap: 2025 Overview

Income and wealth disparities have become the central fault‑line of twenty‑first‑century economics.

Tech Sovereignty & Semiconductor Geopolitics: The 2025 Silicon Battleground

Semiconductors underpin almost every system that makes a modern economy function: smartphones, data‑centre GPUs, grid‑level renewables, avionics, autonomous vehicles, medical diagnostics, hypersonic missiles. The industry’s value is US $697 billion in 2025.

Economic Security under Siege: How Rare Earths, Battery Metals, & Food Became Front‑Lines of 21st‑Century Geoeconomics

A tug‑of‑war over critical materials—and the food that sustains entire regions—now defines the global economic security agenda.

US-EU Tariff Wars: 2018 & 2025 - A Comprehensive Report

The United States and the European Union – two of the world’s largest economies – have clashed in high-profile tariff wars in recent years. In 2018, tariffs that sparked immediate retaliation from the EU, straining transatlantic trade relations. A few years later, in 2025, a new round of U.S. tariffs (largely a revival and expansion of the earlier measures) reignited tensions.

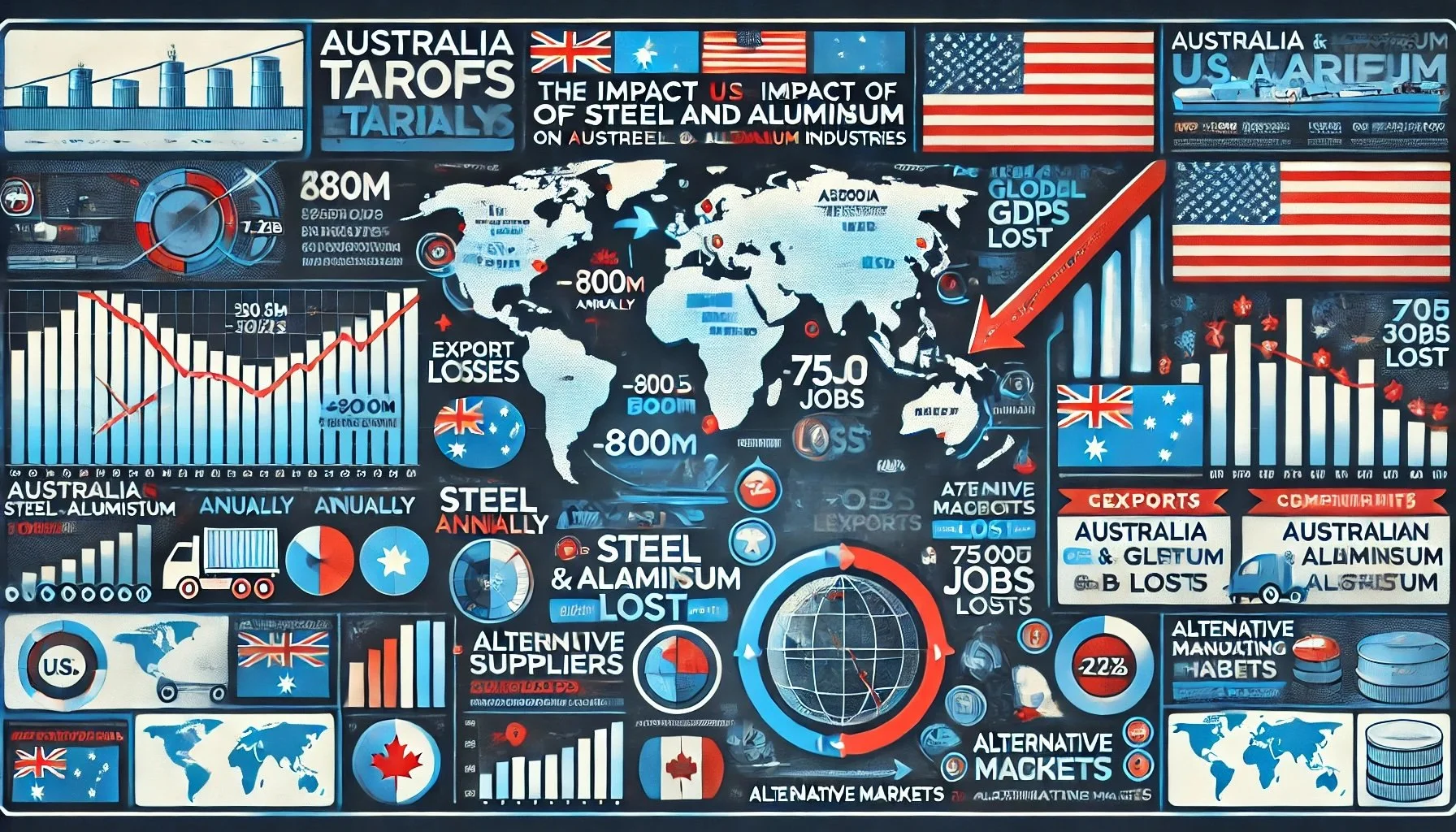

Impact of U.S. Tariffs on Australian Steel & Aluminum Industries (2023–2029)

U.S. tariffs on Australian steel and aluminum will reduce Australia’s exports by $800M annually, lower GDP by 0.02%, and cause 500 job losses by 2029, with Rio Tinto and BlueScope Steel facing major revenue hits. The U.S. economy will also suffer, with $12.5B in lost GDP and 75,000 fewer manufacturing jobs due to higher input costs and supply chain disruptions.

US–EU Trade (2000–2025): A Comprehensive Report

The United States and the European Union maintain one of the world’s largest bilateral trade relationships. Over 2000–2025, transatlantic trade expanded significantly across goods and services, encompassing all major industry sectors. This period saw overall trade grow from roughly $400 billion in 2000 to nearly $1 trillion in goods trade by 2024 , alongside substantial services trade.

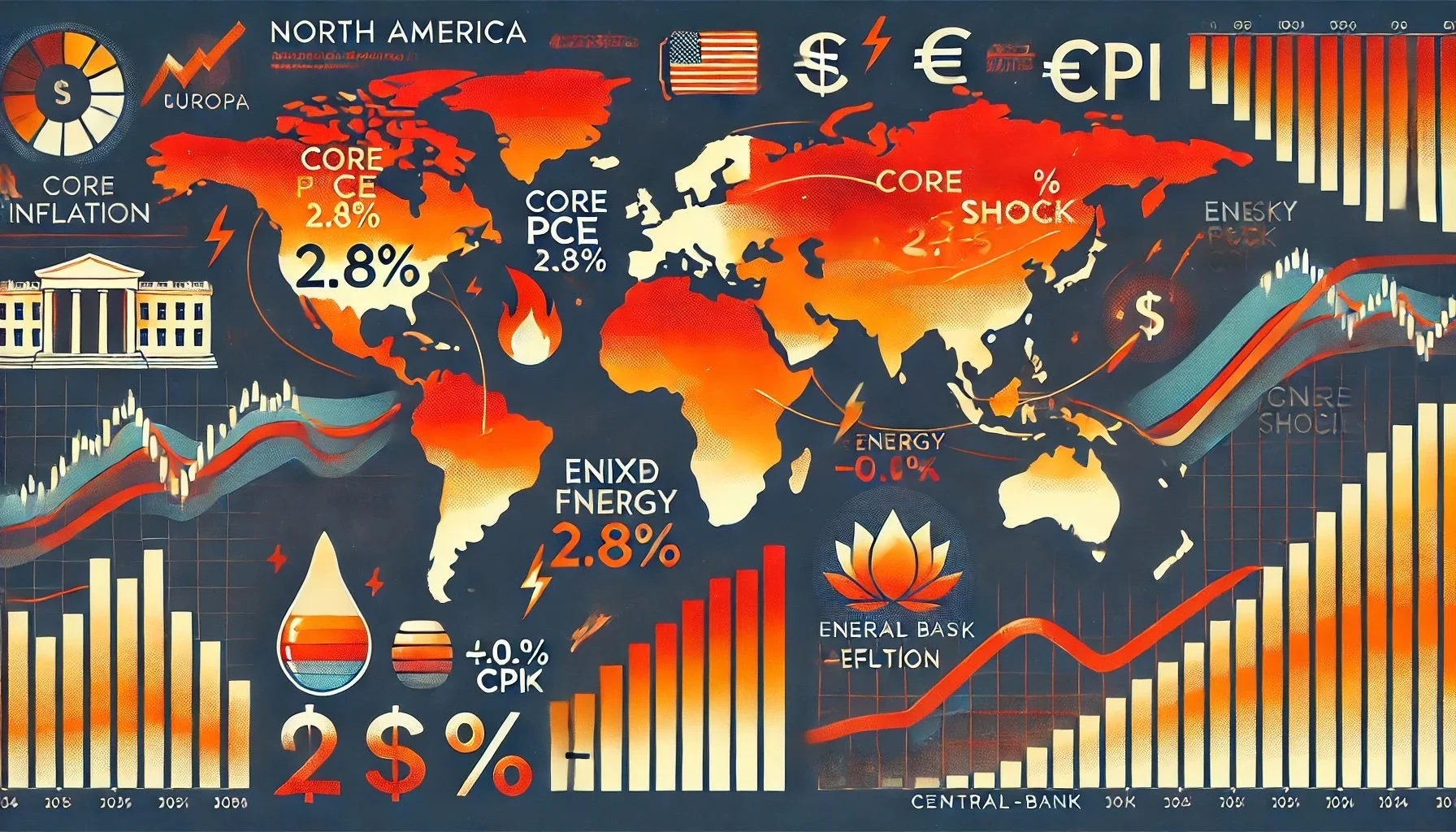

Inflation Persistence vs. Deflationary Risks: A Global Divide

The global economy entered 2025 pulled apart by conflicting price dynamics. In the United States, stubbornly high core and “sticky” inflation printouts have forced the Federal Reserve into the longest stretch of restrictive policy since the Volcker disinflation of the early 1980s.

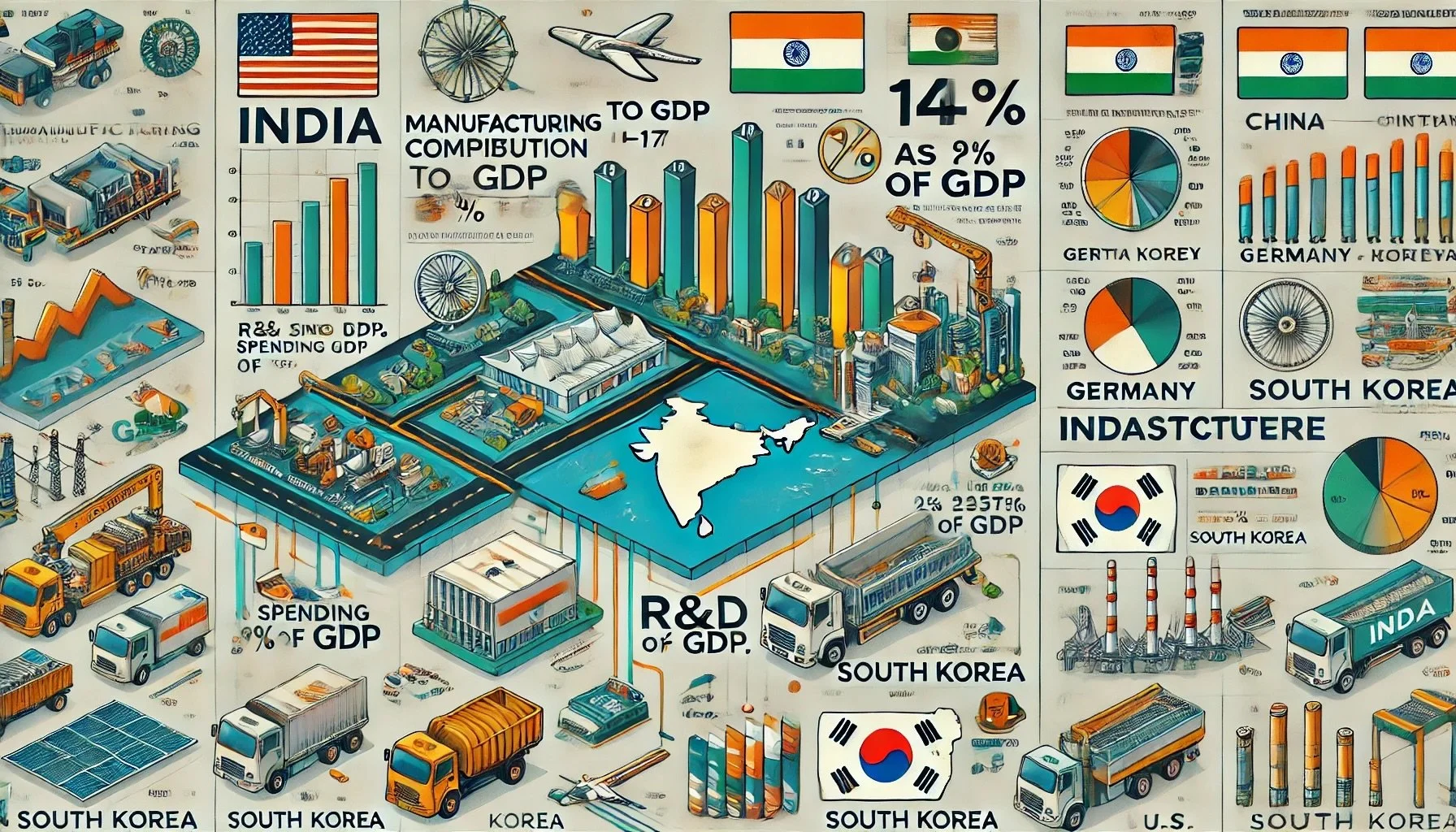

India’s Industrial & Manufacturing Growth: Policies, Challenges, & Global Comparison - A Comprehensive Analysis

India’s manufacturing sector has seen multiple economic stimulus measures and industrial policies since its economic liberalization in 1991. However, despite numerous government efforts such as “Make in India” (2014), “Atmanirbhar Bharat” (2020), Production-Linked Incentive (PLI) schemes, and sector-specific stimulus measures, India has not emerged as a global manufacturing powerhouse like China, Germany, or the United States. The manufacturing sector’s share in India’s GDP has remained stagnant at 14-17%, failing to reach the targeted 25%.

United States-Mexico-Canada Agreement (USMCA) to decode current & future economic uncertainty

The United States-Mexico-Canada Agreement (USMCA) replaced NAFTA on July 1, 2020, introducing new trade policies and economic incentives. Economic analysis of how this trade deal has affected & will continue to impact the three countries in terms of economic growth, labor markets, trade flows, & investment.

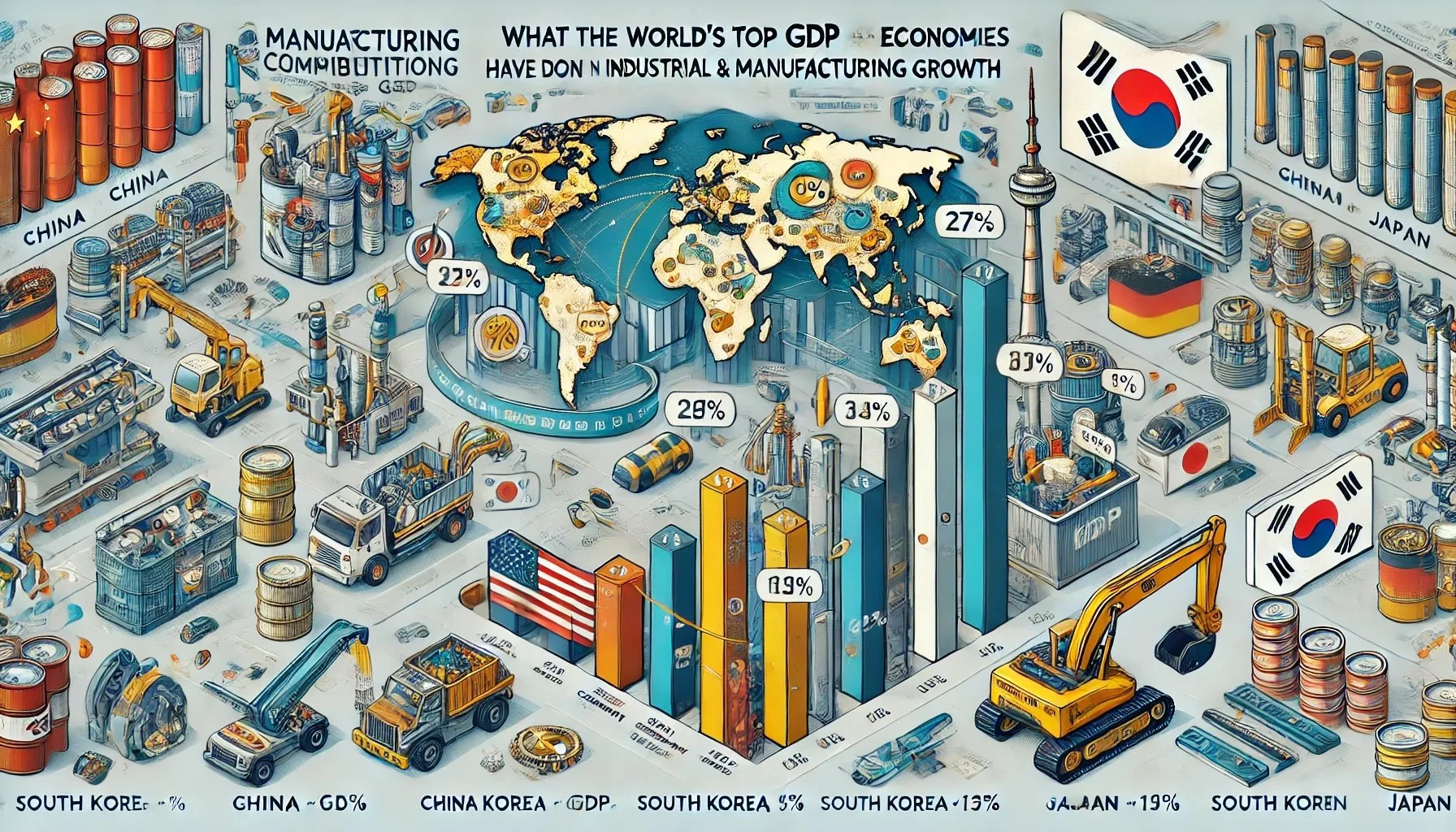

What World’s Top GDP Economies Have Done Right in Industrial & Manufacturing Growth: A Detailed Analysis

The world’s largest economies—the United States, China, Japan, Germany, and South Korea—have successfully developed strong manufacturing and industrial sectors, ensuring consistent economic growth, global competitiveness, and technological leadership. Each of these countries has followed unique yet effective industrial strategies, investing in research & development (R&D), infrastructure, education, supply chains, and regulatory frameworks to build sustainable and globally dominant manufacturing bases.

When Algorithms Meet the Assembly Line: How AI is Re‑Wiring Productivity, Jobs & Policy

AI investment exceeded €130 billion (US $140 billion) in 2023, up fifteen‑fold from 2015. The United States captured €62.5 billion—almost 50 % of the global total—while the EU and UK together attracted just €9 billion. China ranked second with €7.3 billion. Generative‑AI‑focused venture funding is even more skewed: U.S. start‑ups raised €7.4 billion between 2020‑2022, more than double China and Europe combined, fuelling a global race for large‑language‑model (LLM) supremacy.

China’s Resilience After the 2018 Tariffs: How It Diversified and Reduced Dependence on U.S. Trade

In 2018, U.S. imposed steel (25%) and aluminum (10%) tariffs, later expanding to $50 billion in Chinese imports, citing IP theft. China retaliated, targeting U.S. exports like soybeans and automobiles, escalating the trade war. By 2025, despite new 20% U.S. tariffs, China’s trade diversification, domestic demand, and supply chain strength will minimize disruptions. With RCEP, ASEAN re-routing, and steady global demand, trade flows will remain largely unaffected, making the impact weaker than in 2018.

Re‑Shoring, Friend‑Shoring and Near‑Shoring in the 2020s: How Three Supply‑Chain Corridors Are Quietly Redrawing the World Economy

Well before COVID‑19 froze cargo decks and container ports, the geography of production was beginning to creak under the weight of geopolitics, rising wages in China, AI‑enabled automation, and public pressure for “greener, shorter, safer” supply chains.