Fragmented Finance: The Rise of BRICS + & Re‑Wiring of World Economy

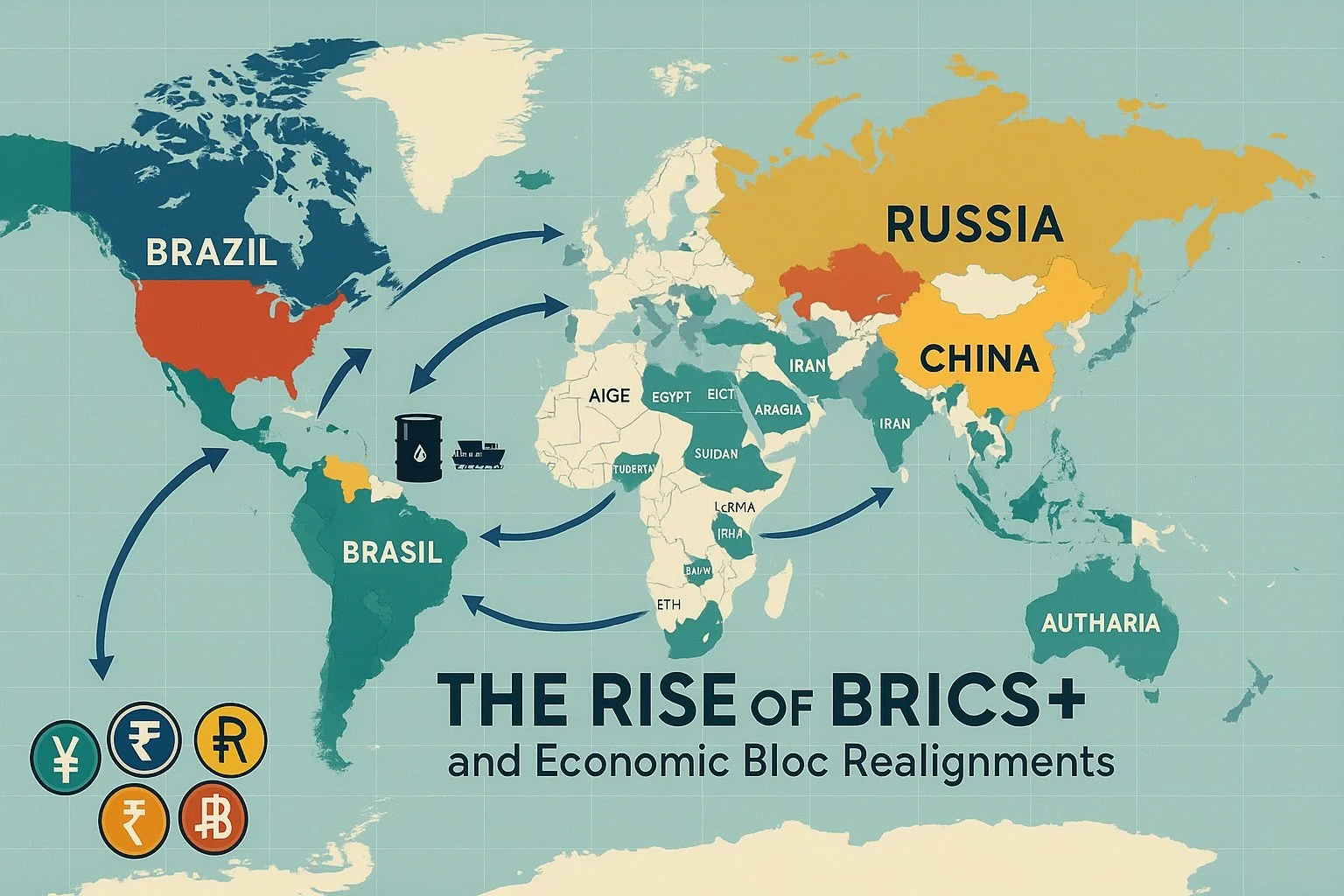

The admission of Saudi Arabia, the United Arab Emirates, Egypt, Iran and Ethiopia on 1 January 2024 formally converted a Goldman‑Sachs acronym into BRICS +, a 10‑nation coalition that now speaks for 46 percent of the world’s people and roughly 35–37 percent of global output at purchasing‑power parity.

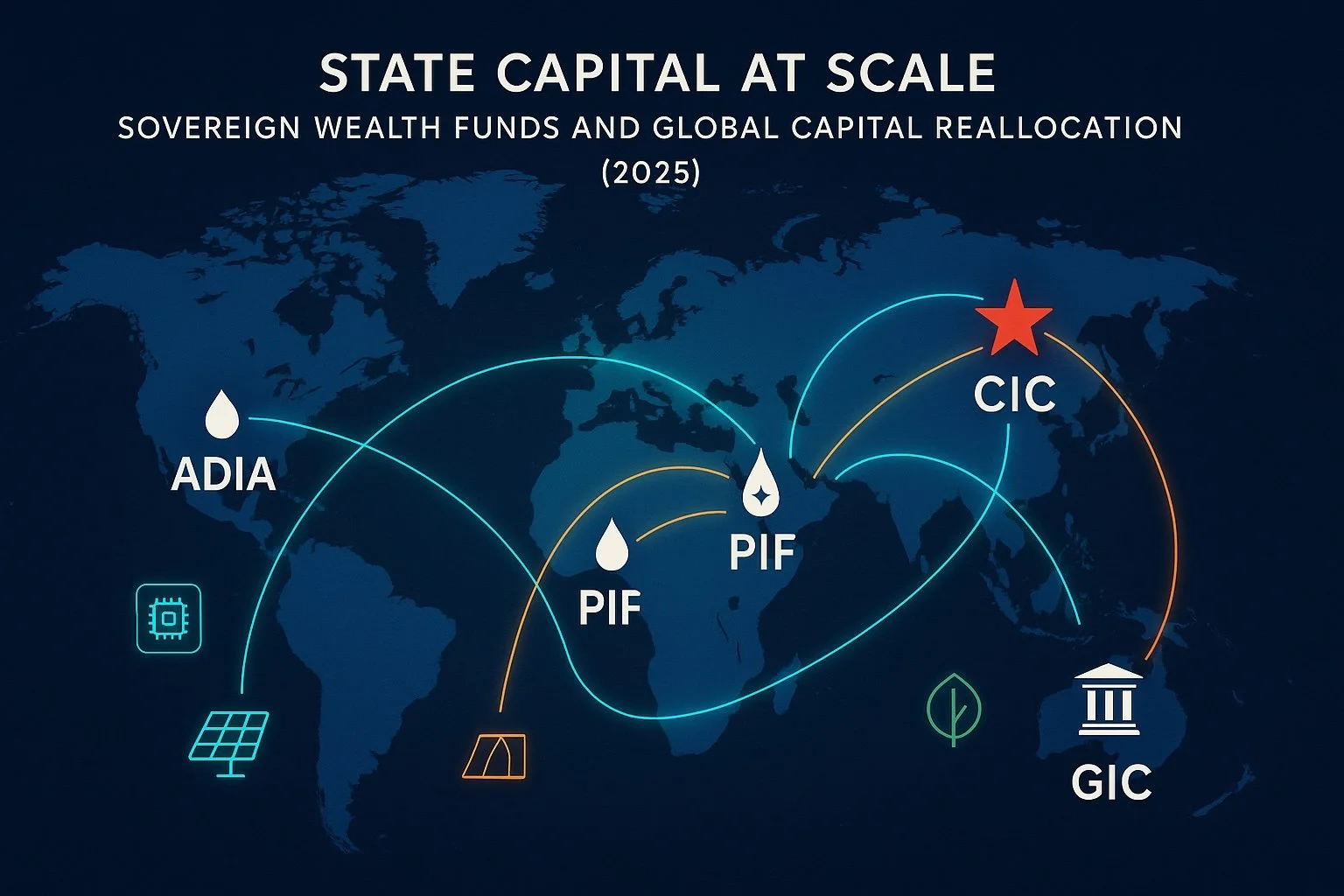

Global State Capital at a Turning Point: How Sovereign Wealth Funds Are Re‑Drawing World’s Financial Map

When the first modern sovereign wealth fund (SWF) was set up by Kuwait in 1953, few imagined that, seventy‑odd years later, government investment arms would collectively steer more capital than the entire hedge‑fund industry and almost as much as the global mutual‑fund complex. Yet that inflection arrived quietly in late‑2024: total SWF assets crossed US $13 trillion, a 14 percent jump year‑on‑year, led by Middle‑Eastern and East‑Asian funds.

Digital Currencies and the Future of Central‑Bank Monetary Tools

When the Bahamas’ Sand Dollar went live in 2020 it looked like an exotic outlier; five years later a sober headcount shows 134 jurisdictions—representing 98 % of world GDP—now actively building, piloting or launching central‑bank digital currencies (CBDCs), and forty‑four of them already run pilots.

Green Money, Greener Futures: How the World’s Largest Economies Are Paying for Decarbonisation

Climate finance has entered a decisive phase. As heat records fall and carbon budgets tighten, the world’s largest economies are racing to translate climate ambition into hard fiscal numbers.

Trade Wars & Tariff Diplomacy: How steel, tech, & agriculture became front lines of a fragmenting global order

The global tariff cease‑fire declared at the Buenos Aires G‑20 in December 2018 now feels like a brief armistice in a much longer conflict. Seven years later, the world economy is still locked in overlapping rounds of “tariff diplomacy” in which governments weaponise duties, export controls, and standards to pursue goals that range from pure protectionism to climate policy and national‑security tech bans.

The Changing Landscape of Global Supply Chains Post-COVID & Post-Ukraine War

A special report on the post‑COVID, post‑Ukraine‑war realignment of global supply chains, with a close look at U.S.–China decoupling, India’s manufacturing ascent and the European Union’s resilience agenda.

EU-India Trade & Economic Relations (1990–2025): A Comprehensive Analysis

India and the European Union (EU) have developed a significant trade partnership since 1990, evolving from relatively modest trade volumes into a major economic relationship by 2025. The EU is now one of India’s top trading partners, accounting for about 12% of India’s goods trade in 2023.

The Paradox of Thrift in a High-Savings, Low-Growth World

The “Paradox of Thrift,” originally coined by John Maynard Keynes, suggests that while individual saving is prudent, collective increases in saving during recessions can dampen aggregate demand, leading to slower economic growth.

Australia-India Economic Cooperation & Trade Agreement (AI-ECTA): A Quick Overlook

The India-Australia Economic Cooperation and Trade Agreement (AI-ECTA) marks a pivotal moment in the economic and strategic partnership between two Indo-Pacific democracies.

Sovereign Debt Risks in Advanced vs. Emerging Markets

Global public debt has climbed back above 99 % of world GDP, nearly five percentage points higher than pre‑pandemic levels. As the “Great Disinflation” of 2022‑24 gives way to structurally higher real rates, servicing that debt is suddenly expensive again. Interest outlays already absorb 5 % of revenues in most advanced economies (AEs) and about 14 % in low‑income countries (LICs)—double the share 15 years ago.

When Worlds Collide: How Diverging Central‑Bank Paths Are Re‑Engineering Global Economy (2022 – 2025)

This special report weaves together high‑resolution data, original interviews, and a broad array of theoretical prisms—from Mundell‑Fleming & Dornbusch overshooting to Hélène Rey’s Global Financial Cycle—to map the spillovers of policy divergence and to gauge where the fractures might open next.

Impact of U.S. Tariffs on Canada & Mexico: A Comprehensive Analysis

The 25% U.S. tariffs on Canada and Mexico (10% on Canadian energy) are disrupting trade, shrinking GDP, and increasing prices. The U.S. could lose $467 billion, while Canada and Mexico face recessions. Auto, energy, and agriculture sectors are hardest hit, with rising car and fuel prices, job losses, & export declines. Canada and Mexico retaliate with tariffs and new trade deals with Europe and Asia, reducing U.S. influence. If sustained, these tariffs could permanently alter global trade and weaken North American economic ties.

Demographic Shifts and Aging Economies: Long‑Term Labor & Pension Pressures

How five of the world’s most‑watched economies are rewriting the rules of growth, welfare, and global power. The world is passing an irreversible demographic inflection. Advanced economies are ageing out; emerging giants are experiencing radically different age structures.

How India, Germany, the US, South Korea & the UK are Investing in Human Capital—and What It Means for Tomorrow’s Workforce

These countries together account for over a quarter of global GDP and—via migration and multinational investment—shape talent pipelines far beyond their borders. Yet their human‑capital strategies diverge sharply, reflecting differences in population age structure, fiscal space, institutional design and cultural attitudes toward “academic vs. applied” learning.

Cross‑Border Labor Mobility & Skilled Migration Economics

An unprecedented contest for talent is underway. In 2024 the U.K.’s net migration fell to 728 000, yet the share of EU‑born professionals leaving outpaced arrivals, deepening a “brain‑drain” narrative.

Financial Market Globalization: Integration or Fragmentation?

In the three decades since the 1990s, capital markets tore down most fences that once confined national savings. From the first cross–border American depositary receipts (ADRs) to the trillion‑dollar, real‑time settlement networks that hum beneath the globe today, the world’s financial plumbing seemed destined for seamlessness.

Post-Pandemic Fiscal Sustainability & Social Spending Trade-offs: Welfare vs. stimulus: France, U.K., U.S. universal basic income trials, India’s NREGA.

Between March 2020 and early 2022 governments spent or back‑stopped more than US $20 trillion—roughly one‑fifth of global GDP—to keep households, jobs and credit systems alive. The result was an unplanned natural experiment in the trade‑off between emergency stimulus and permanent welfare architecture.

The Triple Threat to India’s Economic Growth: Demonetization, GST, and COVID-19: An In-Depth Analysis of the Past Decade and the Road Ahead

The Triple Threat: Impact of Demonetization, GST, and COVID-19 on the Indian Economy (2014-2024): Impact of Demonetization (2016), GST Implementation (2017), and COVID-19 (2020) on GDP growth, employment, government revenue, & industrial production.

Job Market Trends in 2025

Job Market Shifts: Automation and AI – As Predicted?

The World Economic Forum’s “Future of Jobs Report 2025” painted a picture of rapid workplace transformation by technological disruption – with automation, AI, and other trends reshaping labor markets worldwide. It projected significant job churn (roles disappearing and emerging), a pressing need for reskilling, and changes in how and where we work.

Fiscal Deficit & Public Debt Projections (2023-2026) in contrast with Financial Stability Risks: Testing Vulnerabilities Against Reality

The IMF’s Fiscal Monitor (Oct 2024) struck a wary tone on public finances, urging governments to rein in deficits and debt now that the pandemic is behind us . It projected global public debt would exceed $100 trillion in 2024, continuing to rise, and warned that in a severe scenario debt could reach 115% of GDP within a few years .