The Triple Threat to India’s Economic Growth: Demonetization, GST, and COVID-19: An In-Depth Analysis of the Past Decade and the Road Ahead

India’s Economic Struggles in a Global Context

India, once projected to be the fastest-growing major economy, has faced an unpredictable and challenging economic journey over the last decade. From demonetization (2016), the implementation of GST (2017), and the COVID-19 pandemic (2020), the country has encountered three consecutive economic shocks that have altered its trajectory. While the short-term pain was immense, these reforms aimed to modernize the economy, increase tax compliance, and shift India toward digital transactions.

Despite having the fifth-largest GDP in the world, India’s growth trajectory has been highly volatile. Unlike China, which has sustained steady growth even amid challenges, India’s economy contracted sharply during COVID-19 and faced disruptions due to demonetization and GST. The following sections provide an in-depth analysis of how these three factors have shaped the Indian economy and what the future holds.

Demonetization: A Bold Move with Lasting Consequences

What Happened?

On November 8, 2016, Prime Minister Narendra Modi announced the demonetization of ₹500 and ₹1,000 currency notes, removing 86% of India's cash in circulation overnight. The aim was to:

Curb black money and corruption.

Remove counterfeit currency.

Promote a cashless digital economy.

Impact on GDP

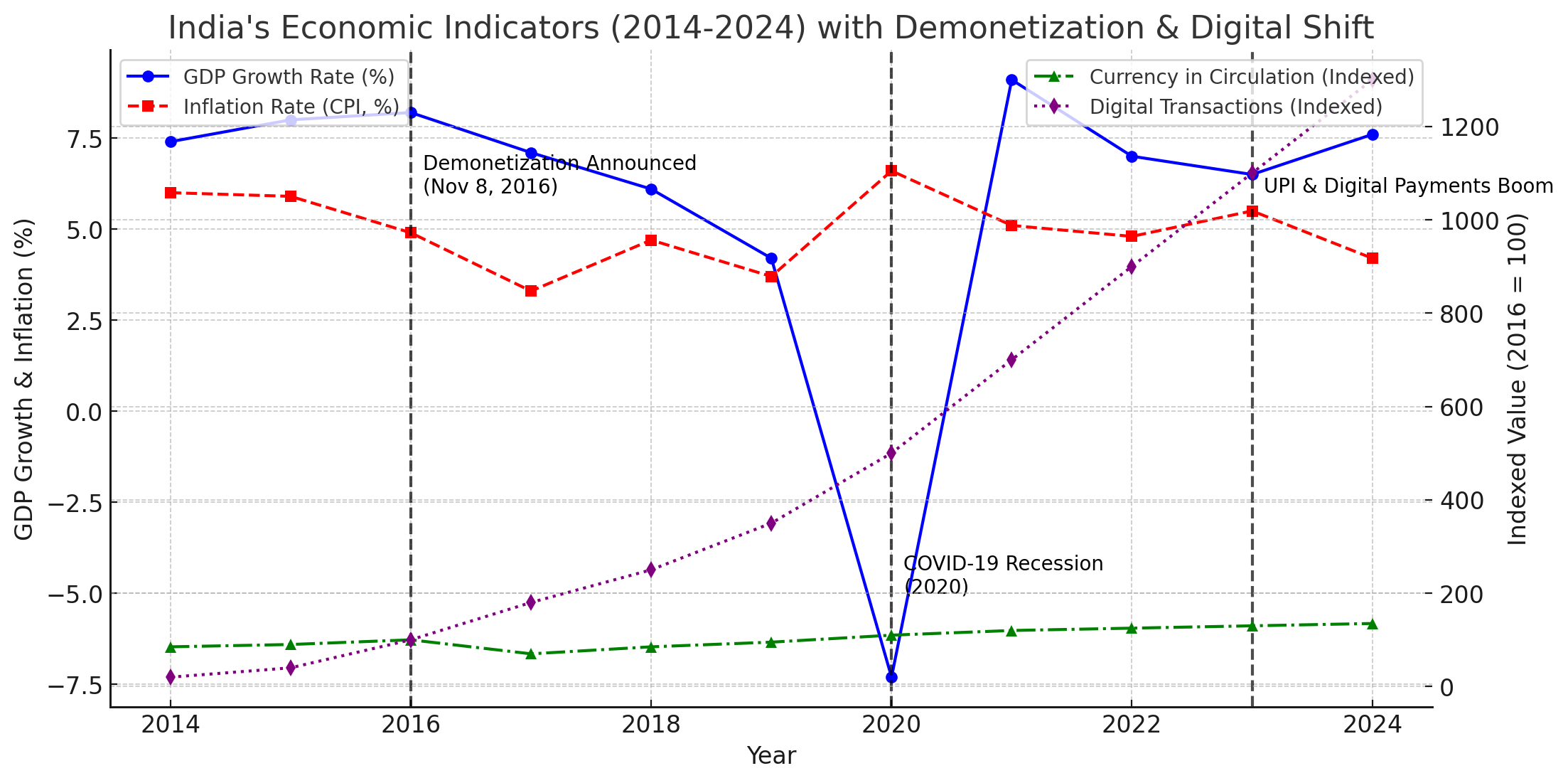

Before Demonetization: India was experiencing 8.2% GDP growth, among the highest in the world.

2017: Growth plunged to 6.1% due to a severe liquidity crunch in the economy.

2018-2019: GDP further declined to 4.2%, suggesting prolonged economic distress.

Short-Term Impact (2017):

• GDP Growth Declined: Economic activity slowed down due to cash crunch.

• Inflation Dropped: Demand contraction led to lower price rise.

• Digital Transactions Increased Rapidly.

Remonetization & Digital Push (2017-2018): The government introduced new currency notes and promoted digital payments.

Economic Slowdown (2018-2019): Structural issues and declining GDP growth were observed.

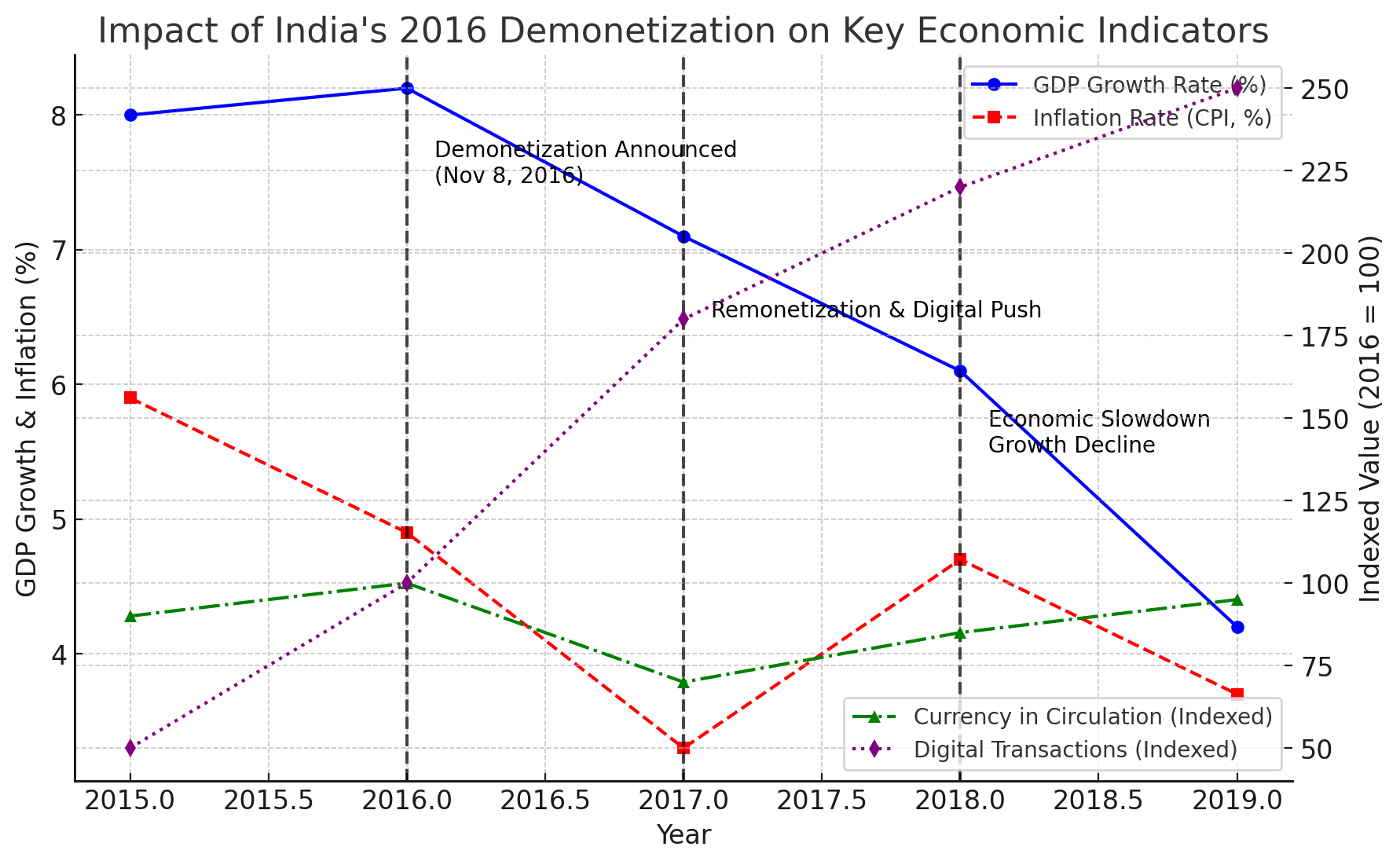

A graph illustrating the economic impact of India’s 2016 demonetization, highlighting key metrics such as GDP growth, inflation, cash in circulation, and digital transactions.

1. GDP Growth Rate:

• 2014-2016: India experienced robust GDP growth, averaging around 7-8% annually.

• 2016-2017: A noticeable dip in GDP growth rate occurred, coinciding with the demonetization event in November 2016.

• 2018-2019: A gradual recovery was observed, with growth rates stabilizing around 6-7%.

• 2020: The COVID-19 pandemic led to a significant contraction in GDP.

• 2021-2024: Post-pandemic recovery showed a steady increase in GDP growth, reaching approximately 7.6% in 2023-24.

2. Inflation Rate (CPI):

• 2014-2016: Inflation rates were moderate, averaging around 5-6%.

• 2016-2017: A slight decline in inflation was observed post-demonetization, attributed to reduced cash-based transactions.

• 2018-2019: Inflation rates remained stable.

• 2020: Pandemic-induced supply chain disruptions led to a temporary spike in inflation.

• 2021-2024: Inflation rates moderated, aligning with pre-pandemic levels.

3. Currency in Circulation (as % of GDP):

• 2014-2016: The ratio remained steady.

• 2016-2017: A sharp decline was observed due to demonetization.

• 2017-2023: Gradual increase, with the ratio reaching nearly 13% in 2023.

4. Volume of Digital Transactions:

• 2014-2016: Steady growth in digital transactions.

• 2016-2017: A significant surge post-demonetization as the populace shifted towards digital payment methods.

• 2018-2024: Continued exponential growth, with transaction volumes increasing from 2,071 crore in FY 2017-18 to 18,737 crore in FY 2023-24.

Visualization of India’s economic indicators from 2014 to 2024, highlighting the impact of demonetization (2016) GDP Growth Decline: From 8.2% in 2016 to 7.1% in 2017., COVID-19 recession (2020) GDP Contraction: -7.3% in 2020, the worst decline in decades., and the rise of digital payments (2023-24)

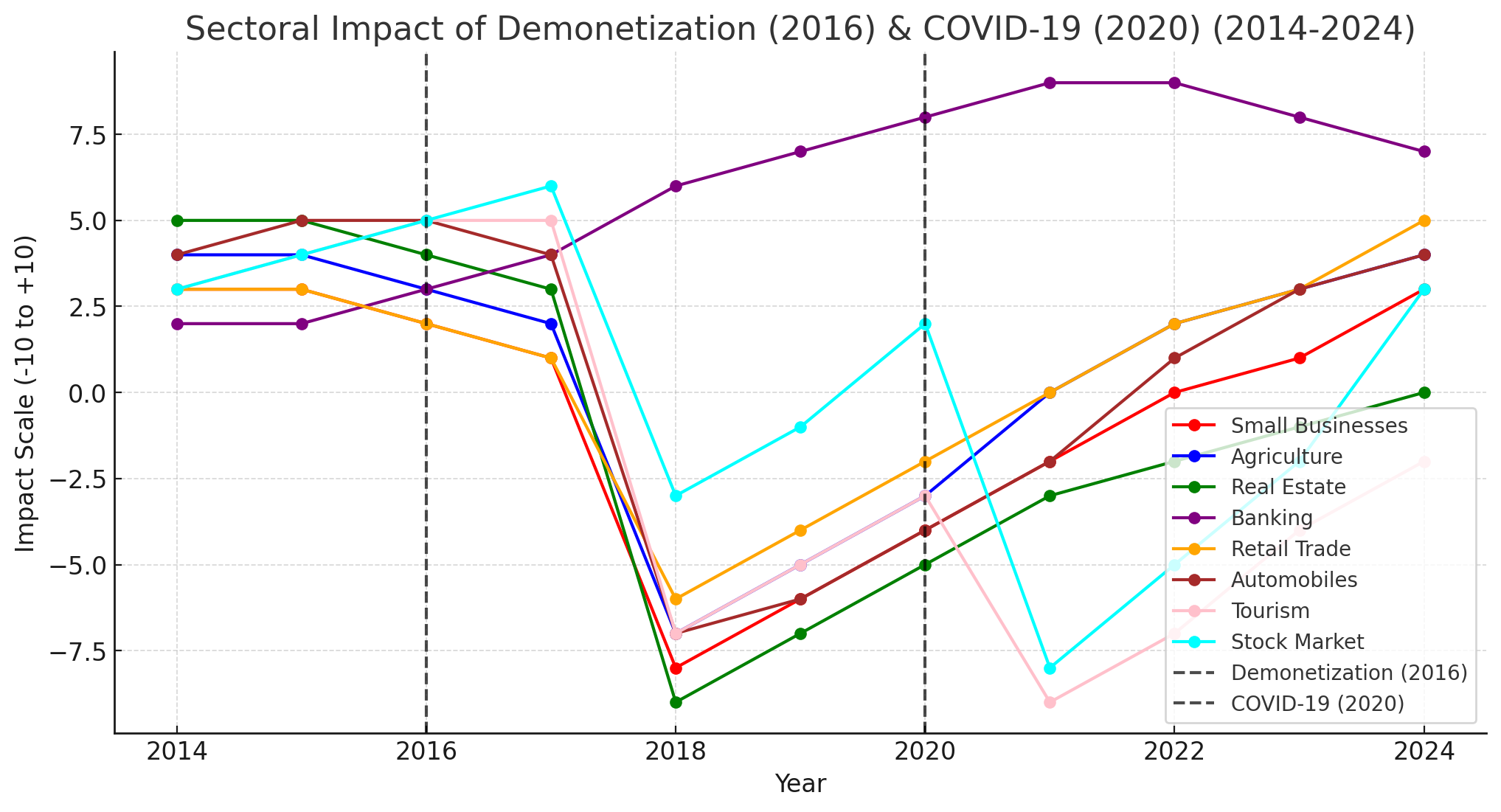

Sector-wise impact of India’s 2016 demonetization: Demonetization disrupted the economy in the short term but led to structural changes in banking, taxation, and digital payments in the long run.

Visual representation of economic resilience and transformation over a decade.

• 2016 Demonetization had an immediate negative impact on cash-based sectors like small businesses, real estate, and retail.

• 2020 COVID-19 caused economic stagnation, with tourism & stock markets being hit hardest.

• 2022-2024 Recovery: Banking, fintech, and stock markets have benefited the most, while real estate and tourism still lag behind.

GST Implementation: A Necessary Reform but Poorly Executed

What Happened?

The Goods and Services Tax (GST) was introduced in July 2017 to replace a complex system of state and central taxes. The main goals were:

Unify India’s fragmented tax system.

Increase government revenue collection.

Reduce tax evasion.

Impact on GDP

Before GST (2016): India’s economy was growing at 8%.

2017-2019: Due to compliance issues, GDP growth slowed to 4.2%.

2020 COVID-19: Made economic recovery even harder.

This visualization illustrates the impact of Demonetization (2016), GST Implementation (2017), and COVID-19 (2020) on GDP growth, employment, government revenue, and industrial production.

India’s economy faces a challenging decade ahead, with GDP growth projected to slow to around 4.2%-4.8% by 2030, significantly below the pre-2016 levels of 8%+. This decline is largely attributed to weak industrial expansion, slow employment recovery, and global economic factors. While government revenue is expected to improve due to GST stabilization and digital economy growth, the employment index is set to decline further, remaining well below 2014 levels by 2030. The lack of recovery in informal jobs lost since demonetization (2016), GST implementation (2017), and COVID-19 (2020), combined with increasing automation, has resulted in persistent job market struggles.

Industrial production is also projected to remain sluggish, still below 2014 levels by 2030, highlighting India’s struggle to scale up its manufacturing sector despite the “Make in India” initiative. To counteract this trend, India needs stronger global investments, improved ease of doing business, and infrastructure expansion. However, the government’s revenue is set to rise steadily, reaching an index of 140+ (2014 base) by 2030, driven by better tax compliance and digital financial inclusion. This revenue growth presents an opportunity for higher infrastructure spending and economic reforms.

To regain 8%+ GDP growth, India must focus on revitalizing its manufacturing sector, increasing job creation, and leveraging its digital economy expansion. While the fintech boom, rising startup ecosystem, and infrastructure policies provide growth opportunities, the country’s economic recovery will largely depend on policy execution, foreign investment, and domestic business reforms. Without these, India risks a prolonged period of moderate growth instead of a return to rapid economic expansion.

Future Outlook (2025-2030)

India's economic trajectory for the next decade will be shaped by multiple factors, including industrial policy, global trade relations, infrastructure investment, and technological innovation. The country must focus on key areas to ensure sustainable growth:

1. Strengthening Industrial & Manufacturing Sectors

India needs to accelerate its Manufacturing 2.0 revolution under initiatives like Make in India and Production-Linked Incentive (PLI) schemes.

The government should focus on automobile, electronics, and semiconductor manufacturing to reduce import dependence.

2. Expanding Digital & Fintech Ecosystem

The UPI boom has already transformed India's payment ecosystem; further investments in blockchain, AI, and digital lending can drive financial inclusion.

Neobanking and cryptocurrency regulations will shape the future of India’s financial markets.

3. Addressing Employment Challenges

Despite GDP recovery, employment growth lags behind. The government needs to promote vocational training and skill development programs to bridge the job gap.

Automation and AI advancements in industries will require a shift in job roles, emphasizing upskilling.

4. Infrastructure Development & Urbanization

Investments in smart cities, transport corridors, and logistics hubs will boost long-term growth.

Green energy initiatives such as solar and wind projects will drive sustainable urbanization.

5. Strengthening Global Trade & Export Competitiveness

India needs bilateral trade agreements with top economies to boost exports of pharmaceuticals, textiles, and IT services.

Strengthening economic ties with ASEAN, EU, and the US will be crucial for market expansion.

India’s Economic Crossroads

While demonetization, GST, and COVID-19 were intended to transform India’s economy, their combined effect slowed down long-term growth. Although India has regained pre-pandemic GDP growth, it still lags in employment recovery and industrial expansion.

If India wants to sustain 8%+ growth, it must:

Strengthen industrial policies.

Invest in infrastructure & manufacturing.

Improve ease of doing business.

The next decade will determine if India becomes an economic powerhouse or continues its struggle with policy-induced slowdowns.