Summary of Foreign & Domestic Investor Activity in Stock Market

Summary Table:

| Country | Foreign Investor Activity | Domestic Investor Activity | |||||||

|---|---|---|---|---|---|---|---|---|---|

| United States | Decreasing | Cautious | |||||||

| China | Stable | Committed | |||||||

| Japan | Modest Inflows | Steady | |||||||

| Germany | Positive | Buoyant | |||||||

| India | Significant Inflows | Optimistic | |||||||

| United Kingdom | Positive | Resilient | |||||||

| France | Positive | Stable | |||||||

| Italy | Positive | Bolstered | |||||||

| Brazil | Resilient | Supported | |||||||

| Canada | Net Outflows | Steady | |||||||

🇺🇸 United States

Foreign Investors: There has been a notable reallocation of global portfolios, with some foreign investors reducing their exposure to U.S. stocks and bonds. This trend is driven by concerns over U.S. policies, corporate profits, and the dollar’s implications.

Domestic Investors: U.S. consumer confidence has plummeted to one of the lowest levels on record, primarily driven by fears over inflation and economic slowdown tied to new tariffs.

🇨🇳 China

Foreign Investors: China’s stock markets have shown resilience, with the MSCI Emerging Markets index holding steady while the MSCI USA index has dropped over 10%.

Domestic Investors: Chinese officials are committed to achieving their 5% growth target for 2025 despite tariff challenges, indicating strong domestic investment sentiment.

🇯🇵 Japan

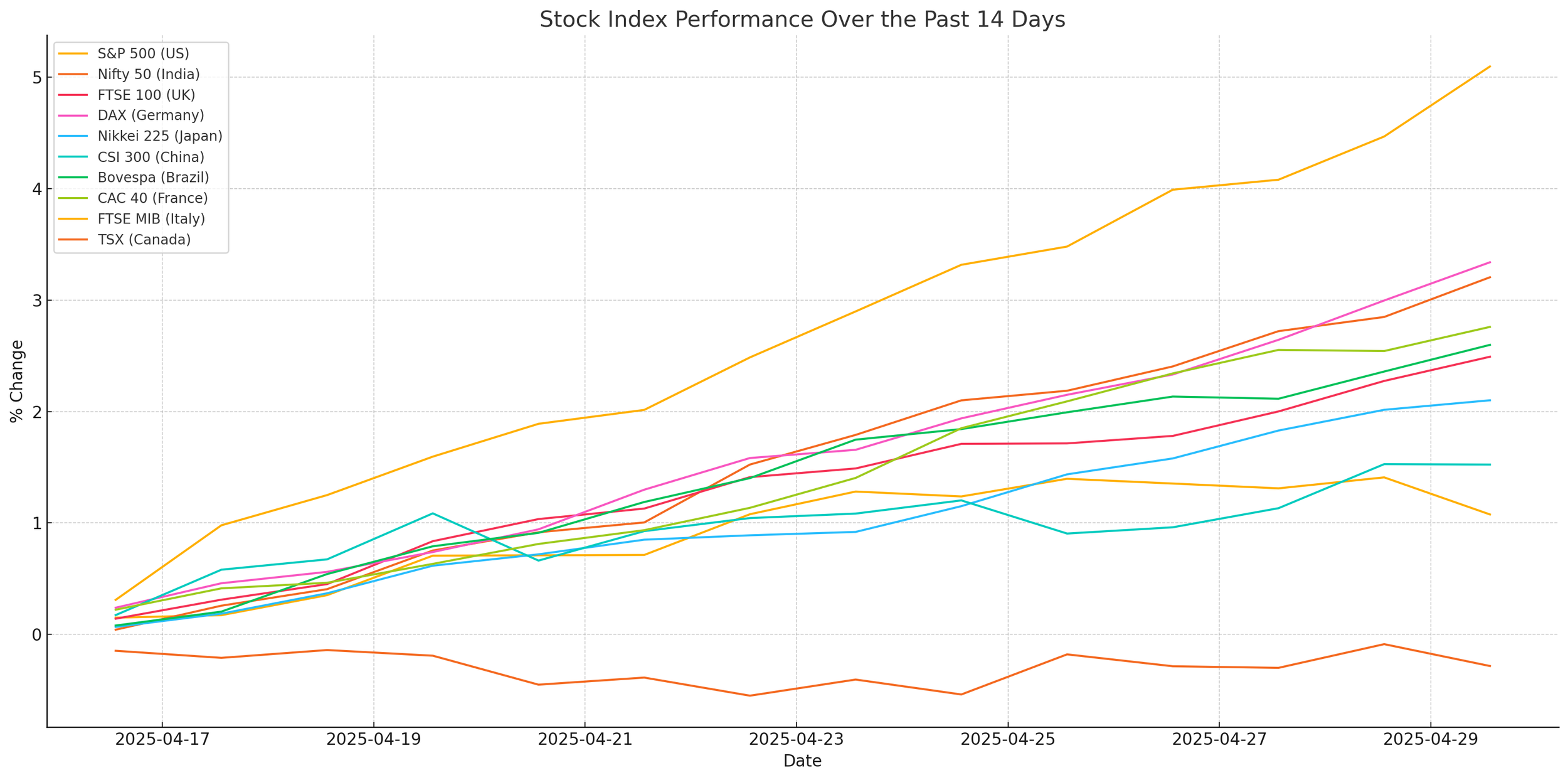

Foreign Investors: Japan’s stock market has seen modest foreign investment inflows, with the iShares MSCI Japan ETF (EWJ) up 1.37% over the past 14 days.

Domestic Investors: Domestic investment remains steady, supported by Japan’s stable economic outlook.

🇩🇪 Germany

Foreign Investors: Germany’s stock market has attracted foreign investors, with the iShares MSCI Germany ETF (EWG) up 2.54% over the past 14 days.

Domestic Investors: Domestic investment is buoyed by Germany’s strong industrial base and export-oriented economy.

🇮🇳 India

Foreign Investors: Foreign portfolio investors have initiated their longest buying spree in Indian equity markets since July 2023, injecting approximately $4.11 billion over the past nine trading sessions. This influx has lifted the benchmark Nifty 50 index by 6.6%.

Domestic Investors: Domestic investors are optimistic, supported by strong corporate earnings and India’s robust economic outlook.

🇬🇧 United Kingdom

Foreign Investors: The UK stock market is on track to extend its longest winning run since 2019, with the FTSE 100 rising for 11 consecutive sessions. This rally is partly due to global capital reallocation and investor preference for defensive stocks.

Domestic Investors: Domestic investment is supported by consumer resilience, as evidenced by a 0.4% rise in UK retail sales in March.

🇫🇷 France

Foreign Investors: France’s stock market has seen positive foreign investor sentiment, with the iShares MSCI France ETF (EWQ) up 1.95% over the past 14 days.

Domestic Investors: Domestic investment remains stable, supported by France’s diversified economy.

🇮🇹 Italy

Foreign Investors: Italy’s stock market has attracted foreign investors, with the iShares MSCI Italy ETF (EWI) up 4.09% over the past 14 days.

Domestic Investors: Domestic investment is bolstered by Italy’s manufacturing sector and economic reforms.

🇧🇷 Brazil

Foreign Investors: Emerging markets like Brazil have shown resilience, with the MSCI Emerging Markets index holding steady while the MSCI USA index has dropped over 10%.

Domestic Investors: Domestic investment is supported by Brazil’s commodity exports and economic recovery efforts.

🇨🇦 Canada

Foreign Investors: Canada experienced a net outflow of foreign stock investment in February 2025, amounting to CAD 6.457 billion.

Domestic Investors: Domestic investment remains steady, supported by Canada’s resource-based economy.